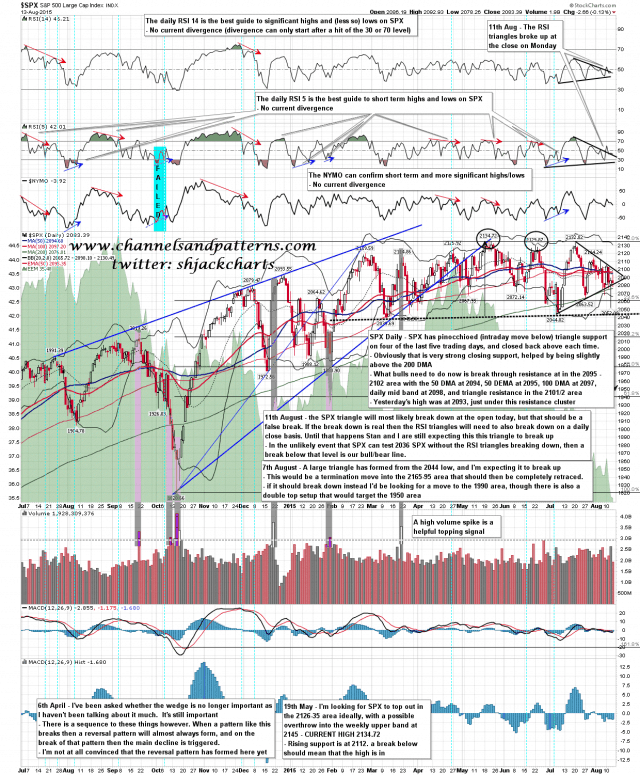

Things have been developing fairly well for the (short term) bull scenario into a final new all time high before a much larger retracement. Triangle support has been pinocchioed four times in the last five days, and held at each daily close, though it took an amazing 30 handle rally on Wednesday afternoon to manage it that day. Bulls need to establish some intraday support below and then go up to break resistance.

That resistance is a strong cluster in the 2094-2102 area composed of the 50 DMA at 2094, the 50 DEMA at 2095, the 100 DMA at 2097, the daily mid band at 2098, and finally triangle resistance in the 2101/2 area. The high yesterday was at 2093, so that was a first pass fail. Bulls need to find some support today and then try again. SPX daily chart:

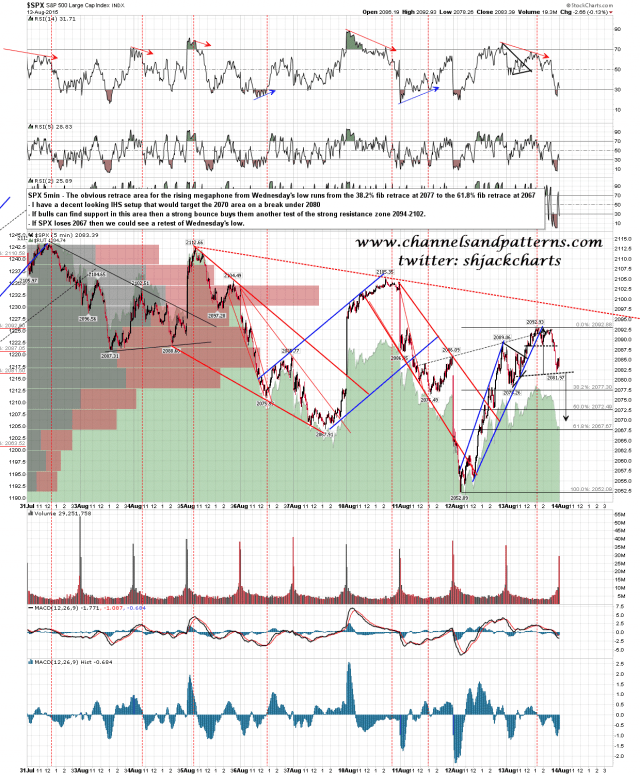

Where should that support be found? Well the move up on Wednesday formed a rising wedge that broke down and then evolved into a rising megaphone. That megaphone broke down yesterday afternoon and a decent looking H&S has formed that would target the 2070 area on a break under 2080. The obvious retracement range runs from the 38.2% fib retrace at 2077 to the 61.8% fib retrace at 2067. Bulls need to find support in this area today or run a very serious risk of retesting Wednesday’s intraday low. SPX 5min chart:

The closing setup yesterday was a bear flag and Fridays have been down nine of the last eleven (stat from my friend Cobra), so I’m expecting some weakness in the morning today. I’d be surprised and concerned to see a daily close below 2085 today as that is the triangle support level.