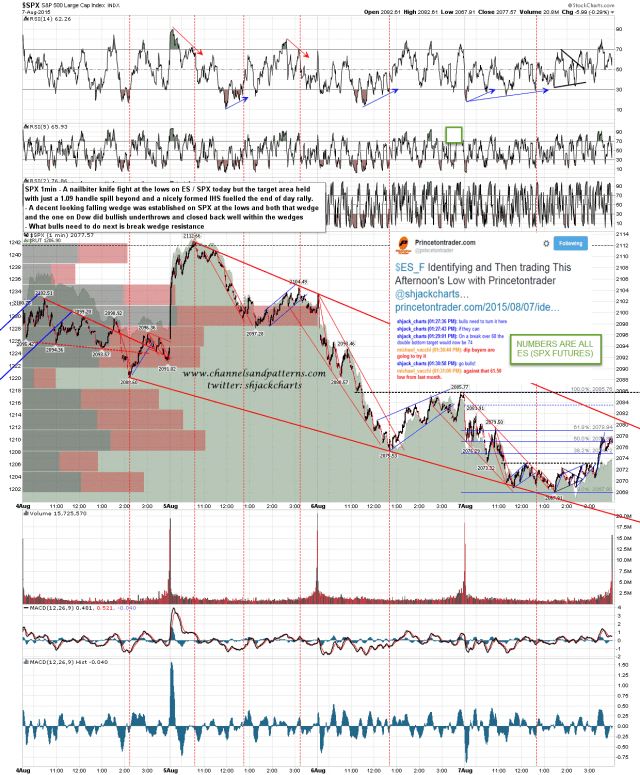

Friday afternoon was very dramatic looking for the low, which overran my target low area by 1.09 handles, and spent a leisurely afternoon building a complex IHS before breaking up towards the end. That was actually a lot of fun in a very primal man vs market kind of a way and a great way to wrap up the week. My trading bud Mike Vacchi has written a post about that which you can see here. So what now?

Well I posted the chart below after the close on Friday night showing the falling wedge on SPX and the first step today is to see whether SPX can break over falling wedge resistance in the 2081 area. At the time of writing it seems likely that SPX will gap over that so most likely that breaks up at the open or later this morning. What then?

I’d normally expect to see a reversal pattern form, not the IHS at the low on Friday as that isn’t proportionate to this wedge, but a larger pattern that would normally be a double bottom or an IHS. There is a very obvious possible IHS neckline in the 2086 area, and while a retest of Friday’s lows is starting to look a long way down, I’ve found in the past that it’s best never to underestimate the ability of any tradeable instrument to retest a significant support level, resistance level, or break. It may be that nobody is expecting to see a retest from here, but I’ve seen similar retests happen a lot, in markets that were looking a lot less two way than this one. I’m not ruling it out here at all, though I prefer the IHS option. SPX 1min chart:

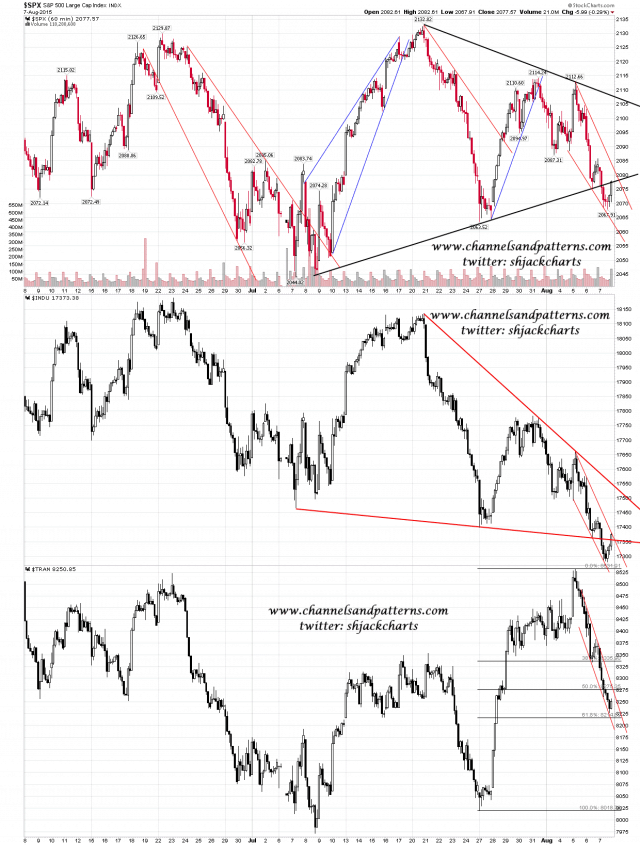

On my 60min optic run charts you can see that all six indices have formed short term (68% bullish) falling wedges, On SPX that is within a large triangle, with what looks so far like a false break down on Friday. triangle resistance is now in the 2107.5 area. On Dow there is a very nicely formed larger degree falling wedge which has now bullishly overthrown …. as long as the next break from the pattern is up. The pattern on TRAN is too large to mark on this chart, but you can see what I’m saying when I say that I have that it a very large, and mostly formed IHS. Screen 3x 60min SPX INDU TRAN chart:

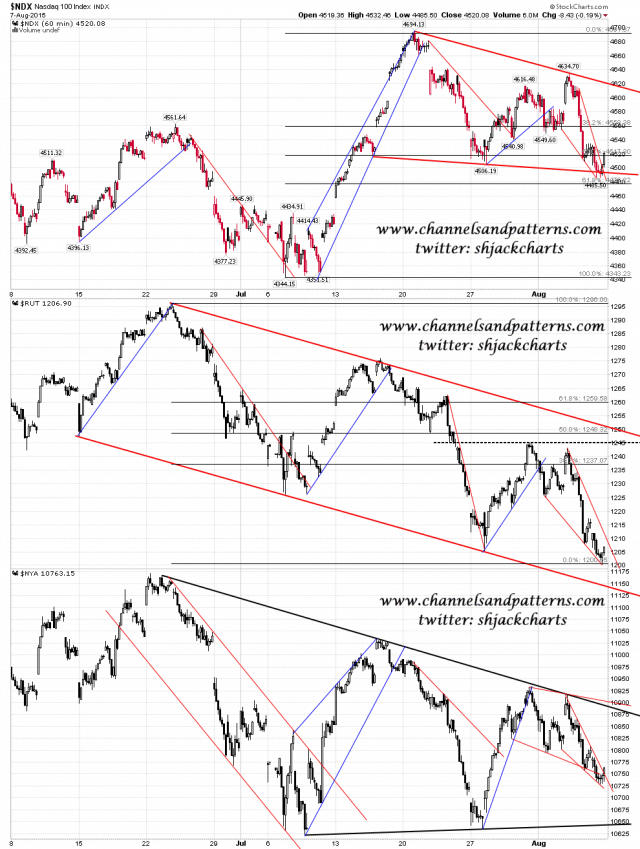

There is a larger degree falling wedge on NDX with a smaller bullish overthrow, a falling channel on RUT with a possible double bottom forming, and a triangle on NYA that has done waves A through E and looks ready to break up at any time. Screen 3x 60min NDX RUT NYA charts:

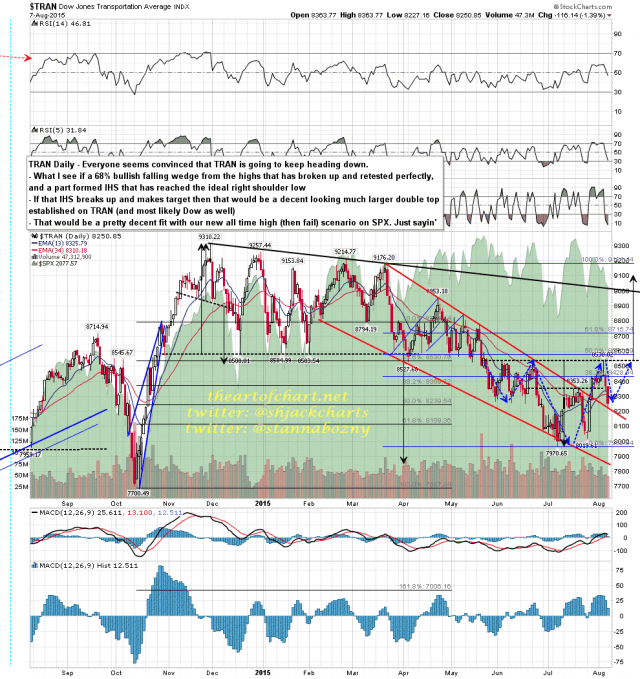

I was taking a bit of flak last week about Stan and I having a new all time high on SPX as our primary scenario, and it was mentioned that TRAN was in such a mess that such a rally seemed very unlikely. Well I had a careful look and TRAN formed a falling wedge from the highs that has broken up and retested perfectly at the lows on Friday. There is also a large IHS forming that if it breaks up, will target almost a retest of the all time high last November. This may not happen, but as I was saying above, never underestimate the possibility of a retest. As a closing move in this interminable topping process, retests of the high on Dow and TRAN while SPX, NDX and RUT make new all time highs would make a lot of sense. Time will tell as always. TRAN daily chart:

Important resistance levels that I’ll be watching today on SPX are the 50 hour MA at 2095, the 50 DMA at 2096, the daily middle band at 2102, and triangle resistance at 2107, though in truth I’m doubtful about seeing a break over 2095/6 resistance today in the absence of a trend up day. .

The link to the video from last nights Chart Chat at theartofchart.net is here.