I remember a trading bud describing the tape in the strong bear move in 2011 as angry badger tape. We’ve been seeing that again this week and I think we could see yesterday afternoon that the badgers are still angry. If you’re trading this intraday then you really might consider taking today off. If you are swing trading then watch the key levels carefully.

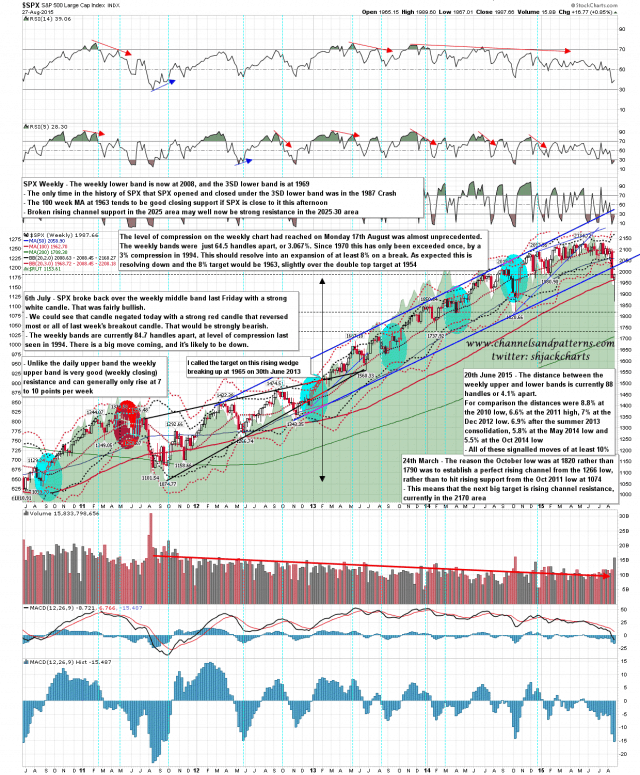

What are the key levels today? There is only one really important one today on SPX and that is the open gap from yesterday morning. That was retested and held in the wild move yesterday afternoon. As long as it holds and bulls make new highs today we should at least test 2000. If that support breaks then the bull case here falls apart and I would draw your attention to the nice looking double top setups on SPX, Dow, TRAN ……….. Scan 3x 15min SPX INDU TRAN charts:

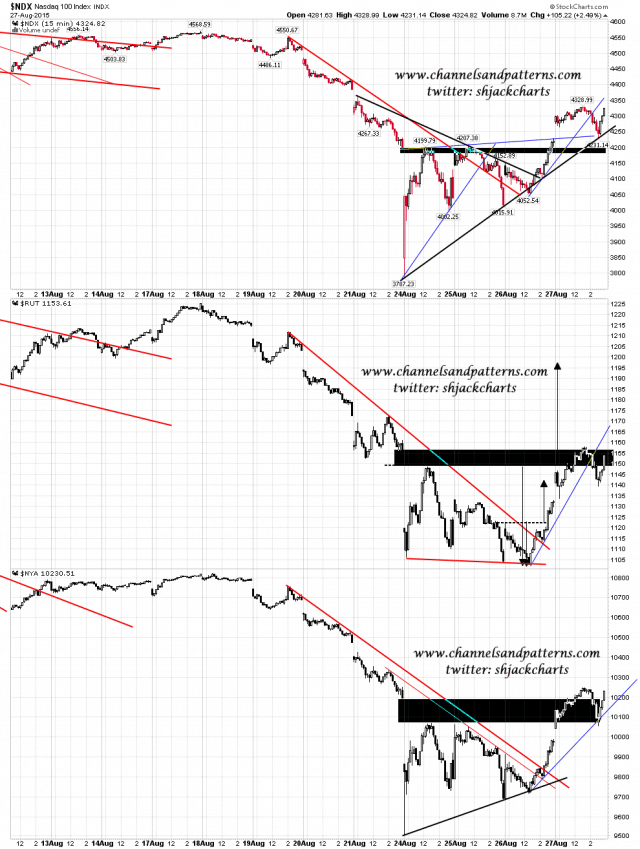

………. NDX, RUT and NYA. Bulls are in must perform here. Scan 3x 15min NDX RUT NYA charts:

On the weekly chart there is decent weekly closing support at the 100 week MA, now at 1963, and at the weekly 3SD lower band, now at 1969. The only weekly candle that opened and closed under the 3SD weekly lower band in the history of SPX was in the 1987 crash, so a close below would be impressive, but would not be the only very impressive stat this week. On the upside the double bottom target is at 2041 and broken rising channel support from 2012 is in the 2025-30 area, and may now be strong resistance. SPX weekly chart:

Today could be wild and treacherous, like much of this week, so trade safe. If yesterday morning’s gap is filled I would suggest being extremely cautious with longs. While it isn’t broken I’d be very cautious with shorts. Stan posted an update last night and you can see that here.