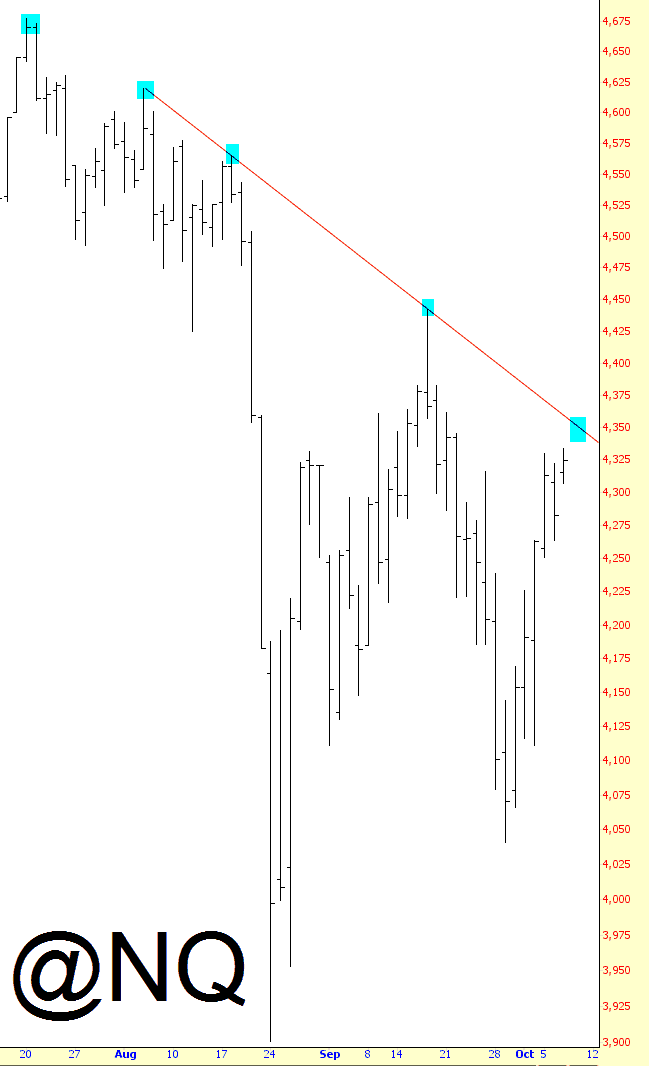

SPX retraced a bit yesterday, rather more so than the daily candle suggested, as the retrace of the channel from Friday’s low to yesterday’s high was close to the 23.6% minimum in a strong trend. I’m expecting more, but it may go the other way.

If we are going to see more retracement then I’m looking for a double top or H&S to form here to take SPX down towards the obvious targets at rising support from the 1871 low and a retest of the daily middle band, now at 1948. SPX 15min chart: