I realize that we’re all getting a bit weary of hearing about Dennis Gartman, his picks, and his fade-worthiness. I heard something, however, which compels me to offer up this post about what he said today on CNBC. The entire clip is here, but the important stuff is beneath it:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

S&P 500: Is it This Simple?

Excerpted from this week’s edition of Notes From the Rabbit Hole, NFTRH 364…

In an age of Algorithms, High Frequency Trading, Quant-injected performance engines and every Casino Patron with an e-Trade account hyper-stimulating the market after each bit of news that is fed (no pun intended) to us by the financial media and Policy Central, the lowly individual can be forgiven for feeling small and vulnerable; for feeling as if the answers are beyond her, or that long-term success is out of his reach.

Indeed, this very publication has ground its gears pondering the fact that August-September market sentiment became historically over bearish in ratio to the relatively minor downside experienced thus far. That was a bullish, not a bearish thing. With sentiment now being repaired it is time to ask if we are giving the bulls too much latitude.

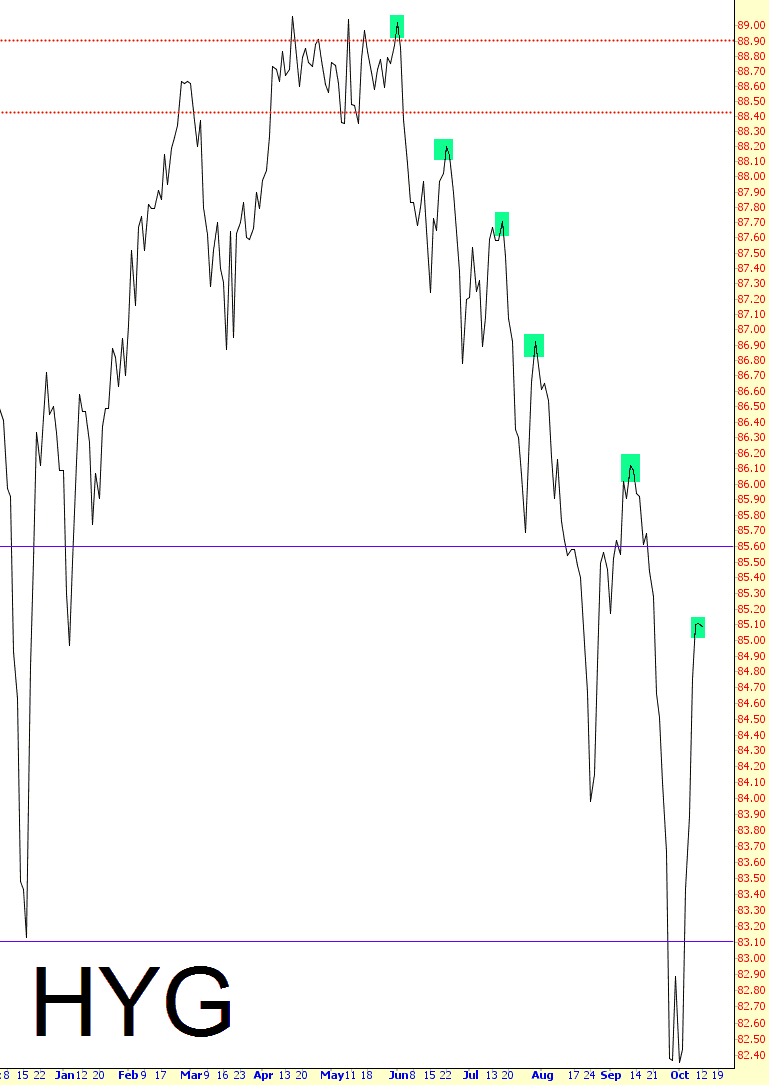

High Yield Tells the Tale

You think this is a buying opportunity? You think we’re heading for new highs? Oh, please, buy! Be my guest! No, no, after you………..

Swing Trading AAPL, GOOGL, KSU, DF, GRPN

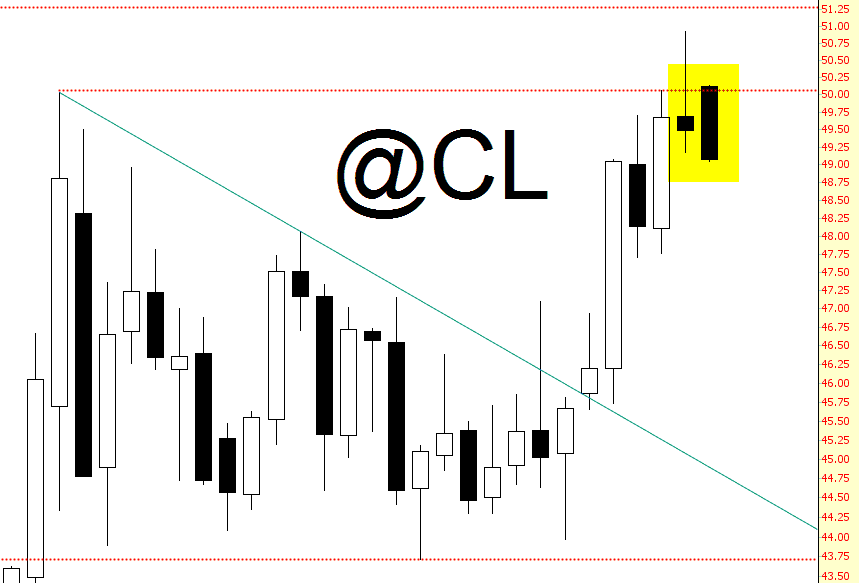

Crude Reversal Begins

For my portfolio, the prospect of crude oil weakening is probably even more important than what the ES is doing. It’s heartening to see that, so far, crude’s surge into the lower 50s is faltering, and we’re painting a bearish reversal pattern on the candlesticks. (NOTE: I actually did this chart earlier in the trading day, and crude has slipped even more).