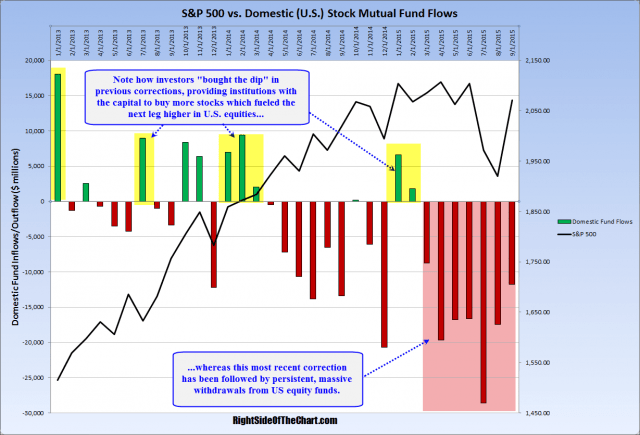

On the chart below, I plotted the month-end values of the S&P 500 against the Domestic (U.S.) Long-term Equity-Only Mutual Fund Flows. Although we don’t have the data for the October month end yet, the first two weekly reporting periods (Oct 7th & Oct 14th) for Domestic Equity Funds have seen net outflows of -$1.31 & -$1.44 billion, respectively, for a total of roughly $2.8 billion in net outflows MTD (data for the week ending Oct 21st should be released in the next day or two).

Note how investors “bought the dip” in previous corrections, providing institutions with the capital to buy more stocks which fueled the next leg higher in U.S. equities whereas this most recent correction has been followed by persistent, massive withdrawals from US equity funds.