Greetings from Atlanta, Georgia, where I’m able to actually use water without guilt (as opposed to California, where we are all praying El Nino actually comes through this winter). I managed to eek my way through the trading day on a plane with a GoGo Internet connection, which is ungodly slow and painful, but it is better than nothing (although just barely).

It was an odd trading day. I was so relieved that the quarter was closed, I didn’t let it faze me too badly that the ES was soaring on the night of the 30th. Gartman finally yelled “Uncle!” in the middle of the night so, as God intended, the markets promptly changed course, and when I woke up they were barely even in the green. It’s too bad the plunge during the day got reversed, and in the end, it was one of those days that might have well just have never bothered opening.

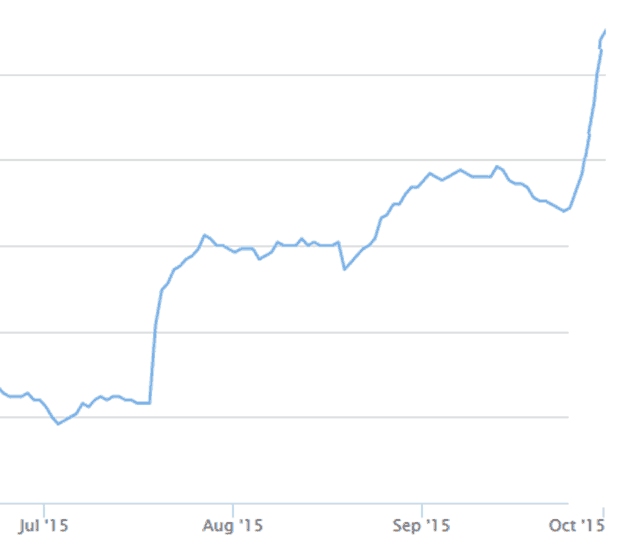

Another interesting quirk of the quarter’s end was the surge in Slope+ subscriptions. I guess nothing motivates people to buy something better than the price of that “something” being scheduled to go substantially higher. Indeed, Slope+ is really booming (this really is the graph, although for privacy reasons, I’ve eliminated the values of the y-axis).

I’m also grumbling less about the supposedly lousy ad revenue, because now the ad revenue (thanks to Slope’s growing popularity and the fact that advertisers like Slopers more and more these days, and are willing to pay to reach them) is roaring higher too. So, for this bear, when it rains, it pours. The market has become more amenable to bears, and as such, all the stuff surrounding Slope is getting more prosperous at the same time. It’s a nice feeling!

Now that we’re starting a new quarter, I feel emboldened. Of course, it seems everyone (including well-meaning Slopers) is still trying to scare the bejesus out of me at every turn, talking constantly about the “face-ripping rally” that’s always around the corner but never really materializes. The simple truth I am trying to hold on to is that, as impossible as it is to believe, the bears are in control of the market now, and the central bankers are just going to be weaker and more terrified as time marches forward.