I received an email today that I found somewhat troubling, and it compelled me to write this post. In the email, the reader was concerned that, in spite of my bravado declared in this weekend’s Sell and Hold post, I had (on Friday and today, that is, Monday) covered a meaningful number of my shorts and had partially retreated. She felt it wasn’t very “transparent” to state, on the one hand, that I hoped to hold onto positions for months, and yet on the other, beat a quick path to the Exit door the moment trouble arrived.

I think it would be beneficial for me to explain my style and method to help reconcile those two realities cited above, because I’m comfortable living with the paradox, and I want readers to know that I’m being forthright with them.

There are three fundamental things to understand about how I trade: (a) I use charts as the basis for my decisions, focusing on short-selling opportunities (b) I tend to hold a relatively large quantity of very small individual equity positions as opposed to one or two large positions (c) I am religious about having stop-loss orders in place to get me out of any position that doesn’t “behave” itself (that is, violate a price that I consider a deal-breaker with respect to the chart, at least for the time being).

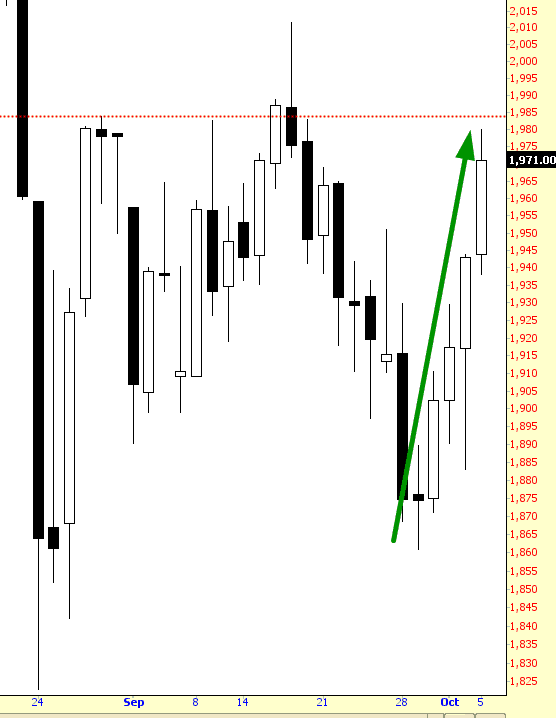

I believe every thing I wrote in my Sell and Hold post quite firmly, but the cold fact of the matter is that when a large quantity of short positions are subjected to this powerful of a rally……….

……..then some……….indeed most……….of the positions are not going to survive. Quite a few are going to get stopped out (many with a loss), and I will be much “lighter” than I was beforehand.

I am not going to simply put on positions and “let them ride” irrespective of price action. Even more so, I’m not going to do something that foolish to make some kind of abstract point. A stop price is a stop price, and it is absolutely my best friend.

But let me hasten to add this point: once the dust is settled, I may well re-enter those same positions shortly thereafter or, perhaps, days or weeks down the road, perhaps those same stocks will have ascended to price points that I find very attractive again on a risk/reward ratio. I am more than happy to reconsider getting into the exact same stock that caused me pain earlier if, at a later date, the chart presents itself as another good setup.

These days, the quantity of positions in my “Bear Pen” watch list (which is where I keep stocks I’d like to short, provided the price gets to a good level) is much bigger than my live positions. As I’m typing this on Monday night, I have 64 short positions. At the same time, I have 125 stocks in my Bear Pen watch list which might……….maybe tomorrow, maybe in a week, maybe never………offer themselves up as appealing new entrants.

I manage one position at a time. I have deliberately decided to maintain a large quantity (absurdly large, for most people) of positions as an act of forced self-discipline, since – as I’ve explained many times – the very nature of this unwieldy beast makes it impossible for me to be capricious.

If positions can “survive” for months at a time, as I described in hopeful terms in my Sell and Hold post, then that’s terrific. Some of them just might do that. But, irrespective of my views or hopes of the market, the stop-loss orders will be in place day in and day out, and if a chart misbehaves by crossing a certain price level, bang, it’s out of there.

In addition I cannot, will not, and do not keep readers apprised of my individual trades. The granularity of my writing on this blog (a post every few hours) is wholly different than the granularity of my trading (real-constant, constant, and instantaneous). No reader should expect to be “on top” of my positions. My last post may have firmly declared how it’s great to be short everything with a ticker symbol, and by the time they read it, I may well be totally flat (although it’s unlikely). This is not done out of deceit. It is simply a reality of my ability to express my feelings juxtaposed with being responsible with my positions.

I hope this clarifies things.