Note: This article assumes the reader knows the reasons we are now bearish on the Semiconductor Equipment sector. NFTRH subscribers definitely do and NFTRH.com/Biiwii.com readers should as well. Readers who have been around a few years also know that we became bullish on the Semi’s in Q1 2013 from much the same reason, in reverse, we are becoming bearish now.

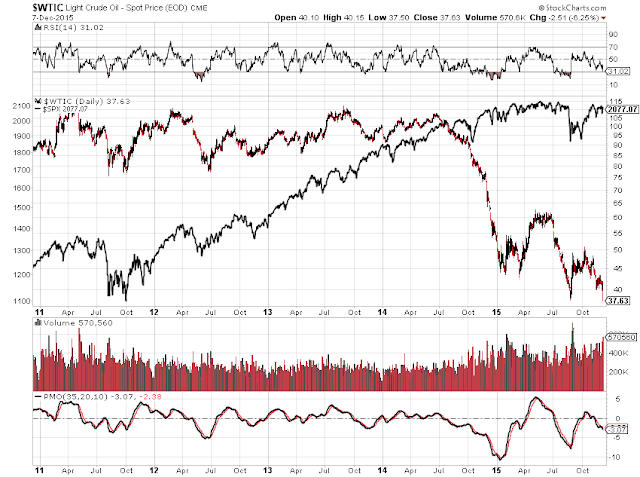

This article was originally and simply titled ‘Market Management’ as the opening segment from this week’s NFTRH 372. We then covered US and global stock markets and precious metals in detail, along with brief but ongoing negativity about commodities (but also what to look for regarding signs of change), a currency update and extensive market sentiment and indicator updates.

As noted recently, my trading had become problematic because I do not have the time, inclination or even the raw talent to day trade, which is what this market has seemed to demand lately. There is no better illustration of the reason why trading has been difficult than what happened on Tuesday through Friday as markets popped up to challenge the recovery highs, tanked hard, seemingly launching the bear view and then ramped again toward the highs on Friday (on a policy maker’s jawbone, what else?).

(more…)