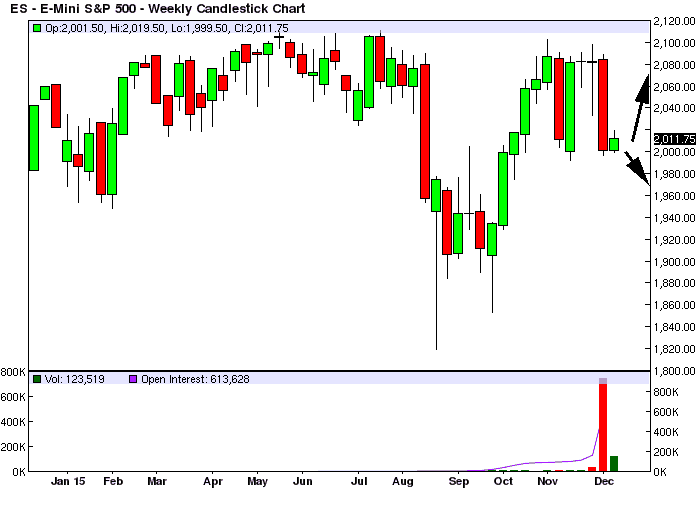

The ESH16 market last week closed down, losing about a 100 points in value from the previous week’s highs. Looking at the ESH16 WEEKLY chart below you can see that the price trend, after recovering, faltered. What have we learned from the last few months? That after a correction there is a mass of buyers ready to step in and push prices back up to the previous top in the ~2100 price area, but as soon as the price reaches that zone the buyers disappear and the market tanks again. Very interesting.

The next valid WEEKLY resistance, according to our quantitative models, is at ~2074, and next valid WEEKLY support is at ~1979 (OVERSOLD).

If there is an attempt to rebound from current levels, the market will encounter WEEKLY/MONTHLY resistance in the ~2074/2166 area, according to our models. There it would be reaching the end of any uptrend, we are not at a major market bottom from where the upside can be considerable.

In short, this means: a rebound is possible soon, but the upside is capped at around ~2100.

Going down into the nitty-gritty of numbers, here below you can see our quantitative LONG model for ES where we compare the Statistical price extension for DAILY, WEEKLY and MONTHLY time periods: using a set of quantitative price analysis performed on thousands of historical retracement patterns data since 1950, we are able to determine where the price is most likely to bounce based on past behavior (as markets always repeat themselves if you look at them from a fractal perspective).

Click here if you want to receive this E-mini S&P500 Analysis every day in your inbox.

The model above shows that the 1974.25 level on the DAILY time period (left column) is very oversold, nearing the 100% value, this means a DAILY bounce (1-3 days on average is very likely from here). This means: maybe you shouldn’t hope your shorts to make much more money in the next 1-3 days as there will be a bounce very soon, maybe as soon as today.

The WEEKLY shows instead a less-OVERSOLD situation at 1979.75, the yellow color code indicates a swing area: price can go lower but the chances to see a LONG reversal increase as we go down more and more on the scale.

The MONTHLY model shows that the market at 1978 is not OVERSOLD at all (green color code), so it could go lower, MONTHLY. This means: the downtrend may continue, in the medium-term.

If you check the 3 gauges on the right hand side, you get an idea of the “compared” odds, the big gauge at the top makes an average of the 3 smaller gauges, and gives you an overall reading of the chances to see a LONG reversal across DAILY, WEEKLY and MONTHLY time periods in the highlighted price areas. If the odds are good on ALL time periods, then the overall chances to see a sustained, lasting reversal are much higher. At the moment we only see a strong probability for a DAILY reversal and a bit better than a coin flip for WEEKLY reversal, so you may want to wait to go SHORT in the short-term, wait for the DAILY bounce (or close your shorts at a profit) and then, after the bounce, you can go SHORT again and use WEEKLY and MONTHLY time periods to gauge how far down the market can go.

Click here if you want to receive this E-mini S&P500 Analysis every day in your inbox.