As I wrote on Christmas Eve, my plan was to ride out the last four trading days of the year without any positions. It’s been pretty agonizing, because I am dying to get very aggressively positioned, and in spite of the market’s surge lately, a lot of my best short picks are falling to pieces. All the same, I am gritting my teeth and counting the hours until this year is over. Just two days to go.

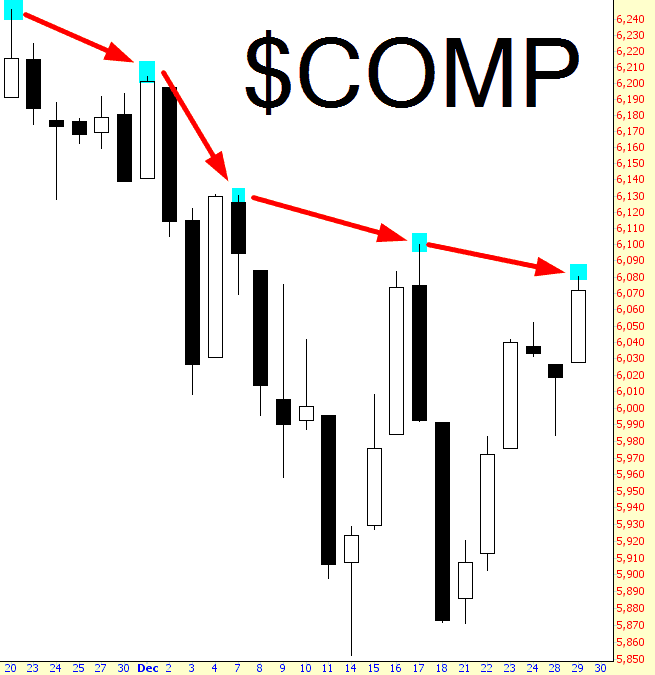

The Dow Composite is still tracing out a series of lower highs.

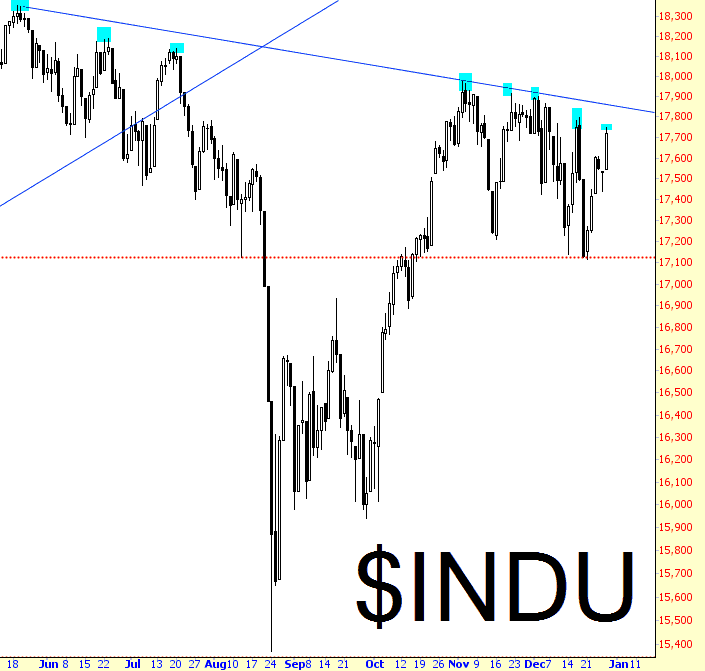

Likewise, the Dow Industrials has done nothing more, surge after surge, than mark subsequent lower highs.

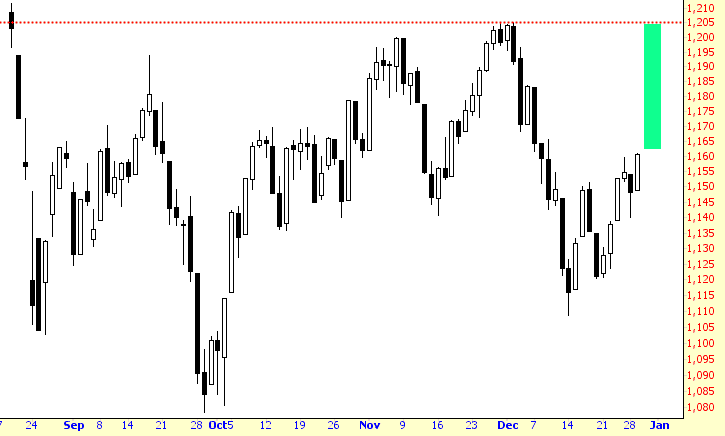

I will say that the Russell 2000 holds the most risk for the bears, since there’s a huge amount of room between present price levels and the most recent high.

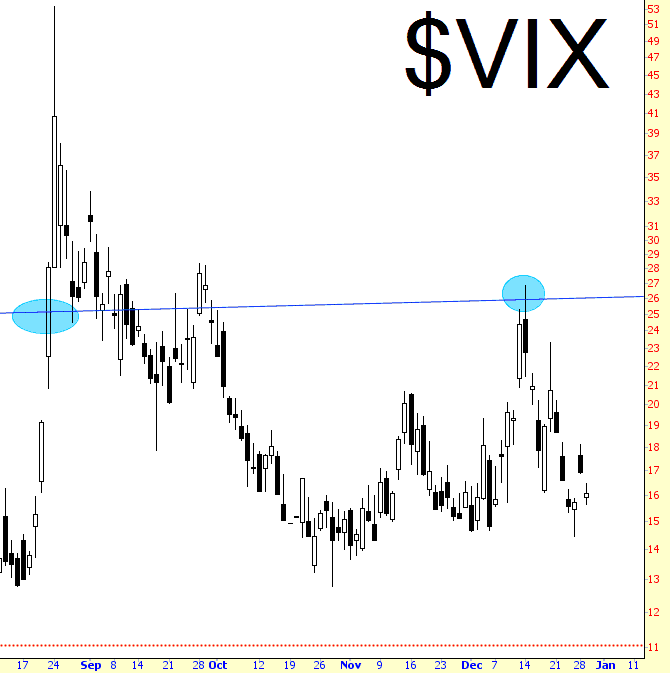

The bottom line for me is that volatility has collapsed again ,and we are scraping along in the mid-teens as we’ve done all the other times that preceded our “fear surges”. I anticipate at least a handful of these mega-surges in 2016, perhaps even one of them greater than the August 24th pandemonium.