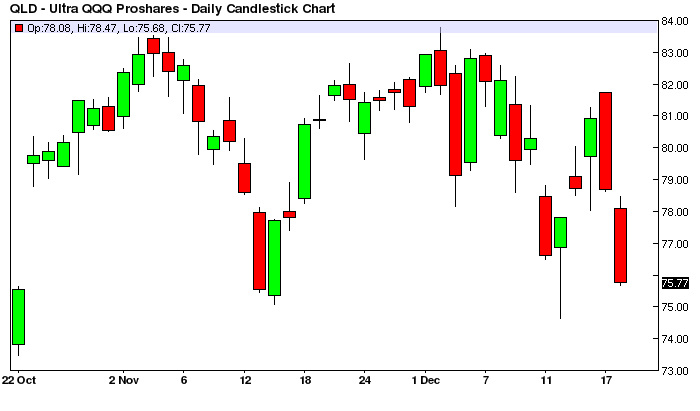

QLD has been down 2 weeks in a row and 2 days in a row. Although not guaranteed, a bounce is probably coming in the next 1-3 trading days. This is the principle of short-term “trend reversal”.

Retracement Levels has developed models to trade several ETFs, Futures and FX markets intraday, DAILY, WEEKLY and MONTHLY. More details on the markets covered are on our website, today we want to show you an example of our DAILY LONG model for QLD: this graph below is part of our model and shows where QLD rebounds more often during retracement patterns that are historically similar to the retracement pattern we are seeing today.

We apply a number of mathematical/numerical/statistical criteria to classify today’s pattern and then we compare it with ALL the similar patterns that happened in the past to see what happened, and then we produce a model that predicts what can happen today. In the graph below you can see this pattern often ends in the price area that today is =77.10-70.91 range. This means that many rebounds in the past started from price areas that today would correspond to this range (actual prices vary in history). So if you go LONG in this area you have a good chance to see a DAILY rebound (usually 1 to 3 days up in a row).

To be more precise, for systematic traders, our model offers the price range expressed in positions to buy at specific retracement levels. This is like a pre-made trading system for the user, you just need to input the data as you seen it on the screen (data can be modified by user to fit risk profile, capital, trade size, etc.). In the model screenshot below you can see that we have highlighted the 74.74-64.72 price area as the place where to go LONG, with high chances of success (65% to 100% of these type of QLD retracements down will end in this price area and a bounce up will follow).

Click here if you want to gain access to all our quantitative trading models, we cover a number of selected ETFs, FX Spot, Indices and Futures markets (full list).