This is a scream:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

We Have Run Out of Customers (by Bob Kudla)

Let me explain:

The concept is beyond supply and demand, at some point the price gets to a point where there is not enough buyers at any price that makes sense to produce or serve, and for the world this has now become a structural problem, and will turn deflation into a depression. Capital owners are resisting lowering their rate of return at a slower rate than consumers ability to purchase their goods and services.

Background (more…)

Gasoline Going for the Big ONE (by MoneyMiser21)

While most of the energy sector focus is on oil (/cl), it’s the gasoline futures (/rb) which are nearing the next big level.

Zooming out to the monthly chart on /rb, we see that price has already traded beneath the lowest monthly close of from the 2008-09 crash (Dec. 2008, white dash line) at 1.062.

The next target is a big one, as in 1.00 even (blue solid line). That’s a price not seen since January 2009.

Beneath that we have the 2008-09 crash low of 0.785 hit in December 2008.

There is NO SIGN of slowing the downward momentum, which means certain parts of the county could see $1.00 or lower gas prices at the pump should we re-test that 2008 low.

The one factor which will come into play starting with the March contract will be seasonality, and the general drift higher of gas prices into the Summer driving season.

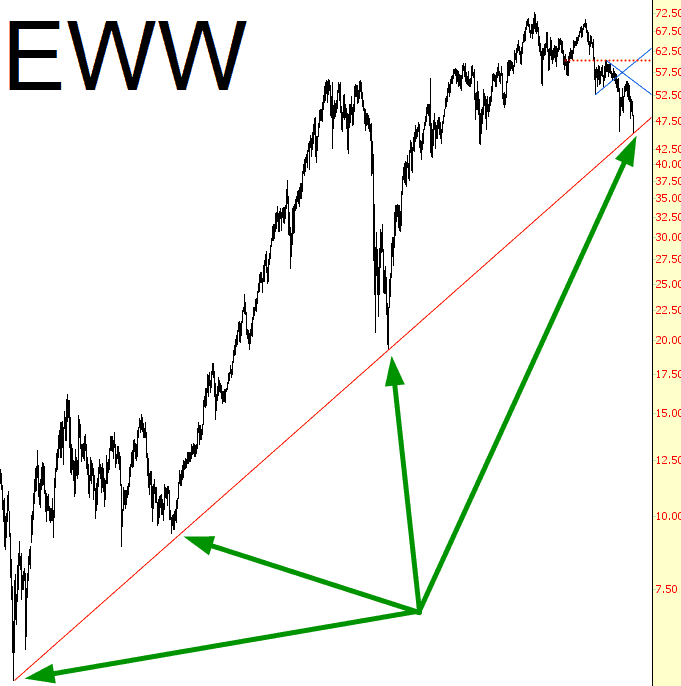

Si, Mexico!

Well, here’s a long idea for a change! Mexico has reached major support, and I think it’s time for a bounce. As for myself, I’ve lightened up to 57 short positions, none of them big, and no ETFs. As of this moment, 36 are profitable, 21 are not, and I’ve adjusted stops across the board. I’m only about 2/3rds committed right now, and I’d like to see how this bounce plays out before pushing back in. Anyway, here’s the Mexico chart: