Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Harry Boxer’s Charts of the Day

Breaking Up Seems Hard To Do

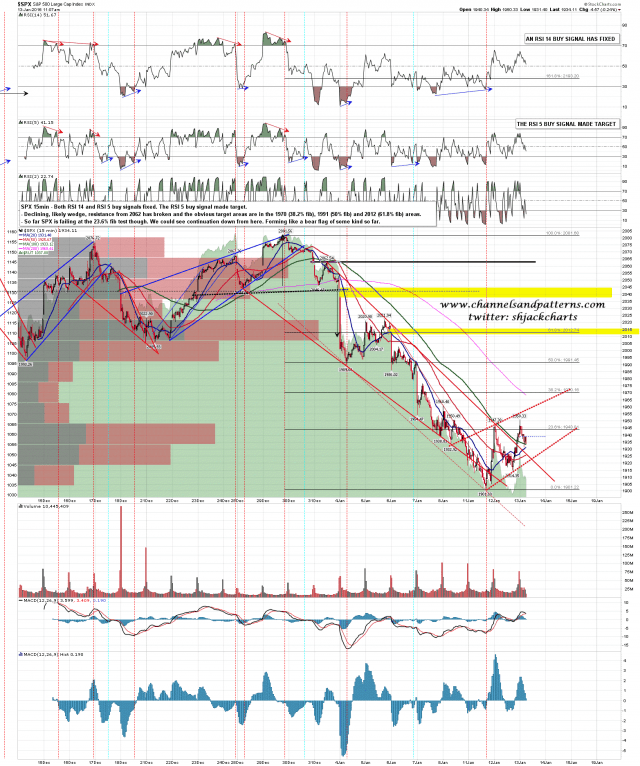

Yesterday started with a perfect hard rejection at my wedge resistance at 1947, but after a 33 handle decline SPX reversed back up and broke wedge resistance. At this stage I’m looking for a reversal pattern of course, and in the absence of the retest of the lows that didn’t happen yesterday, it is still very much a possibility that the lows will still need to be retested to make the second low of a double bottom.

The pattern setup from the low isn’t that clear, but so far it looks a lot like a rising wedge that would be a likely bear flag on the bigger picture, On a break below wedge support, at 1922.5 at the time of writing, the bear flag target would be either a retest of the low or the full flag target would be in the 1790-1800 area. I’d be leaning strongly towards a retest of the low or a marginal new low. SPX 60min chart:

Update on Slope Plus Portfolio

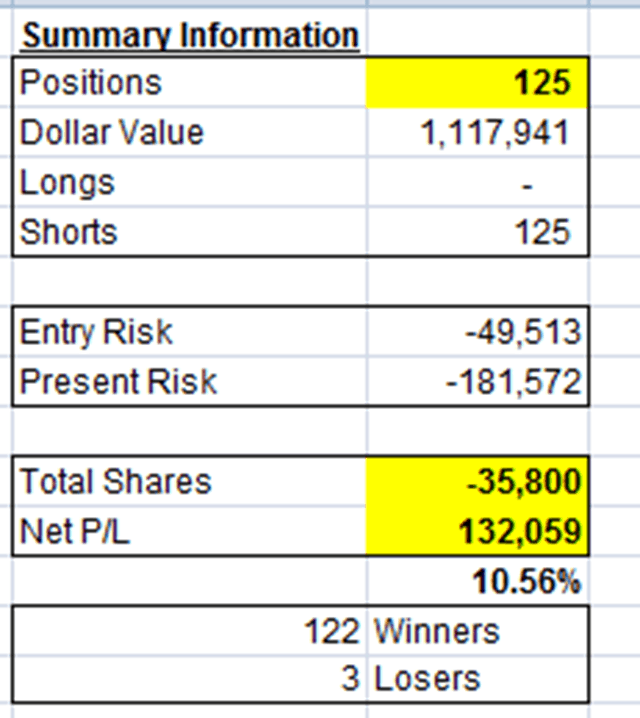

Well, we aren’t even two weeks into the new year, and here’s how the 125 Slope Plus ideas I offered up to my subscribers are doing right now

As you can see, there are only 3 losers out of 125 ideas offered up on January 1st, and only one of those three is a meaningful loss (the symbol was FIVE). We’ve got a profit of 10.56% as of this writing, and a profit of over $130,000 based on $10,000 put into each idea equally.

I wonder how Cramer is doing?

A Hedged Bet Against Small Caps

Another 3x Bearish ETF Appears In Our Top-10

Happy New Year, Fellow Slopers.

I just saw a 3x bearish ETF (TZA) pop-up among the ten highest-ranking names on Portfolio Armor‘s daily ranking of optionable stocks and exchange-traded products by potential return net of hedging cost. Usually, it’s just stocks in that top-10, but the last time an ETP appeared there it was another bearish ETF, YANG. I posted about that here in November (“A Hedged Bet Against China“), and since then, YANG has gone on a decent run. Maybe something similar will happen with TZA? Just in case it goes pear-shaped, though, I’ve posted a hedge for it below. First, a quick look at how YANG has done since our November post on it.

Background On How We Calculate Our Ranking (more…)