The ES market (S&P500 Futures) according to our quantitative models has reached a VERY OVERSOLD price area from where a WEEKLY rebound should happen soon. Lower prices are possible if the bottom falls off and there is a sudden crash, but barring that scenario we should be seeing a WEEKLY bounce this week or the next.

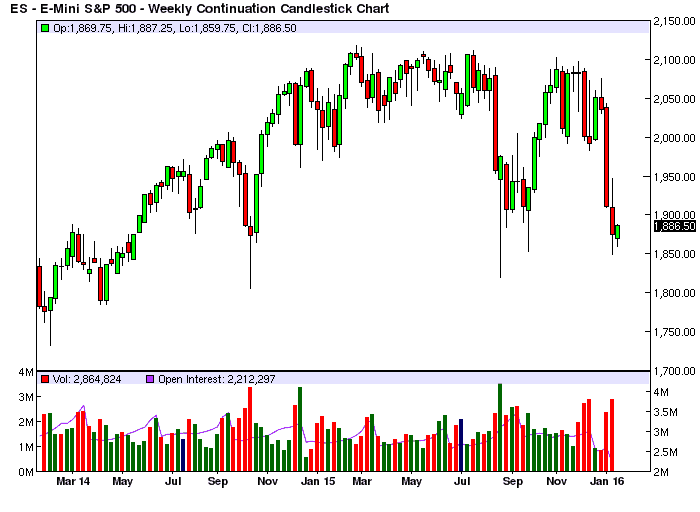

The ES chart below shows the ES market’s current situation:

Here below you can see a comparative analysis of DAILY, WEEKLY and MONTHLY time periods (our quantitative model). Prices around 1837.50 are OVERSOLD DAILY (100% limit) and prices around 1827.75 are OVERSOLD WEEKLY (100% limit). This means: anywhere between 1837 and 1827 the market is DAILY+WEEKLY OVERSOLD. A confluence of OVERSOLD prices across multiple time periods is a strong confirmation signal that the market is OVERSOLD, as explained in this video.

The RL Odds Calculators are proprietary research tables with information that helps the trader determine if a market is oversold or overbought, providing the trader with a unique edge and the ability to execute trend-reversal trades that have a high chance of success.

Currently we have a Special Offer for SOH Readers providing advanced training (RL Trading Course) to teach any trader how to use our models from zero:

Discount Coupon Code: 91C485DAF1

Using the above discount coupon at check out, you can get a -300 USD discount on our current Special Offer that includes one Year of 24/7 online access to ALL the HOURLY/DAILY/WEEKLY/MONTHLY RL Odds Models and Odds Comparators and CCOC Models and also the RL Trading Course. This is a great offer, and was never presented before here on Slope of Hope – it’s valid only for a limited period and for a (very) limited number of users.