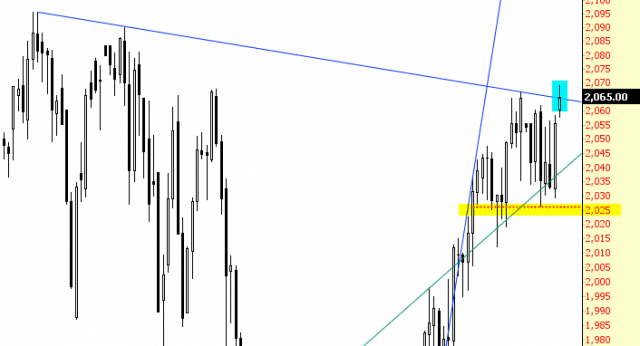

A few days ago, when ES made the current rally high, ES hit the Crazytown level that I mention from time to time as an extreme overbought level relative to the 45 day pivot. That level is at 2068.5 today and has already been hit overnight. I’m looking for a stronger push into the Crazytown area today and ideally a hit of declining resistance from the 2134 high on SPX, currently in the 2090-2 area and that is approximately in the 2082-5 ES area. I’m expecting that hit, if seen today or possibly tomorrow morning, to be the rally high, at least for a strong retracement.

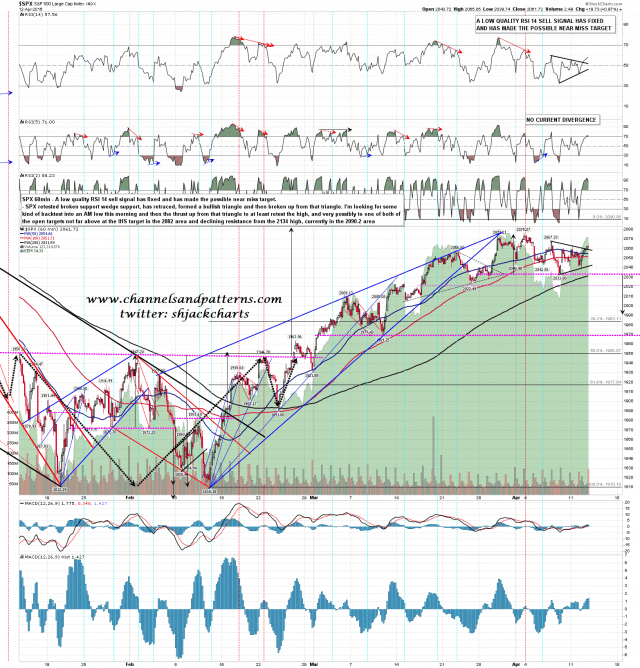

Obviously SPX has taken the bullish option that I was favoring yesterday morning and is likely to at least retest the current rally high at 2075 today. That move is a break up from a bull flag as I mentioned yesterday morning and is also, though less definitely, a break up from a bullish triangle. If the triangle is right then I’d expect to see a decent backtest into an AM low this morning and then a thrust up into the new rally high, most likely in RTH today. SPX 60min chart: