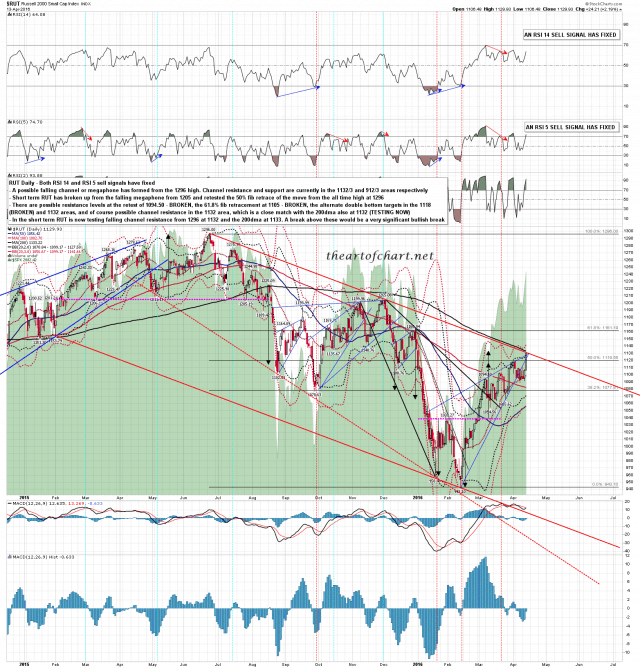

As expected all three of SPX, NDX and RUT retested the highs yesterday and made marginal new highs. RUT has now made the ideal target area, though if possible I’d like to see a marginal new high in RTH this morning two handles higher. This is a major resistance test with big implications if we should see a break through it. RUT daily chart:

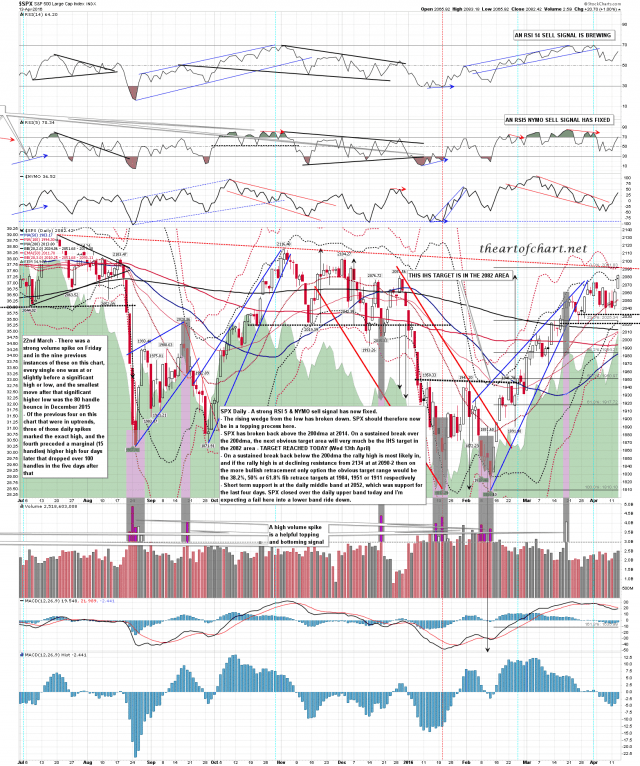

SPX was a little more shy of trendline resistance yesterday. I’d ideally like to see a new high of seven handles or so this morning to deliver the ideal test of major resistance. SPX daily chart:

ES has already made a marginal new high in globex and a 60min sell signal fixed overnight. ES Jun 60min chart:

All three indices have been compressing for a while and an expansion is likely to be starting here. In practical terms that means that there is a high probability that a daily upper or lower band ride on is SPX starting here, and SPX closed over the upper band yesterday of course. If resistance in the 2090-2 SPX area breaks then we may well see a daily upper band ride into new all time highs highs over the next few days. If it holds then we may well see a daily lower band ride instead. I’m expecting resistance to hold and would give 80/20 odds in favor of the bears on this setup.

There are sell signals everywhere on the daily charts except on the SPX daily RSI 14, though a sell signal is brewing there now too, and that would fix on a rejection here. ES and NQ had 60min sell signals fixed overnight and TF would start a 60min sell signal brewing on a marginal higher high today. I rarely get to see an RSI signal setup that is this unanimously directional. The ‘Crazytown’ overbought level is at 2077 ES this morning (2084/5 SPX area) and ideally I’m looking for an AM high in the 2090-2 SPX and 1132/3 RUT areas and then a hard fail. We’ll see how that goes.