A Grim Pattern Repeats

On Sunday, as America reacted to news of its worst-ever mass shooting, Eddy Elfenbein shared a prediction:

Eddy was, of course, right: Smith & Wesson (SWHC) closed up nearly 7% on Monday, and Ruger (RGR) closed up 8.5%. It’s been a pattern: after a mass shooting, there is speculation that the shooting will lead to tighter gun control measures; investors bid up shares in gunmakers as they anticipate that gun sales will spike due to calls for gun control, but the tighter gun control measures won’t come to pass.

Chances are, that will be true this time as well, but there are a couple of reasons why this time might be different.

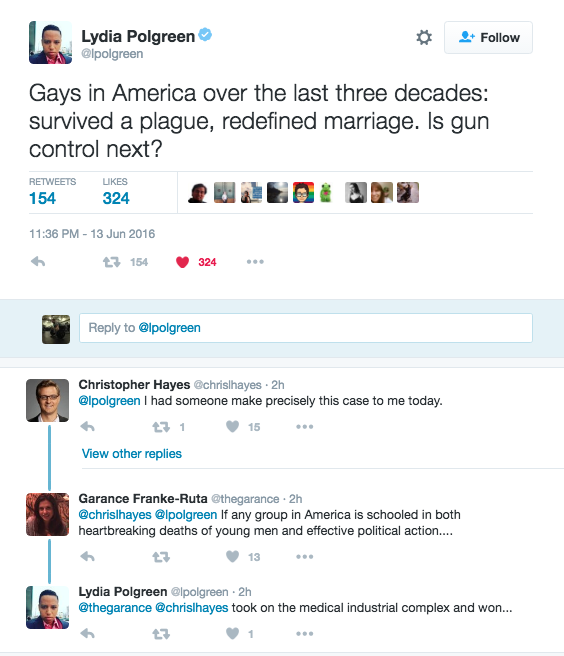

- The victims targeted in the Orlando atrocity were members of a community with a history of effective political action. This point was made on Twitter (TWTR) by Lydia Poolgreen of the New York Times, and seconded by Chris Hayes of MSNBC and Garance Franke-Ruta of Yahoo (YHOO) Politics.

- Donald Trump has altered the political status quo. Trump’s preferred policy response to the Orlando attack, as detailed in his speech Monday, was not to further restrict the sale of guns, but to instead to restrict immigration from countries with histories of violent extremism.

The New York Times cast Trump’s approach as a rejection of pluralism. Ordinarily, in an election year, the odds of federal gun restrictions being legislated would be close to zero. The Republican base tends to be pro-gun, and its representatives follow suit. What’s different today, though, is the wedge between the Republican base and its legislators, as illustrated by Trump’s rise. Although Trump and his policies are popular with the base, some Republican legislators have taken steps recently to distance themselves from Trump, as House Speaker Paul Ryan did last week, criticizing some of Trump’s comments as racist. Might President Obama exploit this wedge by reaching out to Ryan now? What better way for Ryan to burnish his reputation with Beltway pundits than by reaching across the aisle while repudiating Trump?

The New York Times cast Trump’s approach as a rejection of pluralism. Ordinarily, in an election year, the odds of federal gun restrictions being legislated would be close to zero. The Republican base tends to be pro-gun, and its representatives follow suit. What’s different today, though, is the wedge between the Republican base and its legislators, as illustrated by Trump’s rise. Although Trump and his policies are popular with the base, some Republican legislators have taken steps recently to distance themselves from Trump, as House Speaker Paul Ryan did last week, criticizing some of Trump’s comments as racist. Might President Obama exploit this wedge by reaching out to Ryan now? What better way for Ryan to burnish his reputation with Beltway pundits than by reaching across the aisle while repudiating Trump?

Adding Downside Protection To Smith & Wesson

Admittedly, the prospect of Speaker Ryan partnering with President Obama to pass gun control legislation is unlikely, but investors ought to consider the possibility of it. It wouldn’t be the first political event this year that was once considered unlikely. Another reason to consider adding downside protection to Smith & Wessen if you want to stay long now is in case its earnings release scheduled for Thursday dissapoints. We’ll look at two ways of hedging Smith & Wesson over the next several months below. If you’d like a refresher on hedging terms first, please see the section titled, “Refresher On Hedging Terms” in our recent article on hedging Disney.

Hedging SWHC With Optimal Puts

We’ll be using Portfolio Armor’s iOS app to find optimal puts and an optimal collar to hedge Smith & Wesson below, but you don’t need the app for that if you’re willing to take the time to use the process we outlined in this article.

Whether you run the calculations yourself using the process we outlined or use the app, another piece of information you’ll need to supply (along with the number of shares you’re looking to hedge) when scanning for optimal puts is your “threshold,” which is the maximum decline you are willing to risk.

This will vary depending on your risk tolerance. For the purpose of the examples below, we’ve used a threshold of 16%. Ordinarily, we’d write that if you are more risk-averse, you could use a smaller threshold, but, in this case, it was too expensive to hedge SWHC against a smaller decline over the next several months using a lower threshold. In fact, this hedge is quite expensive, so we are including it mainly for illustration purposes.

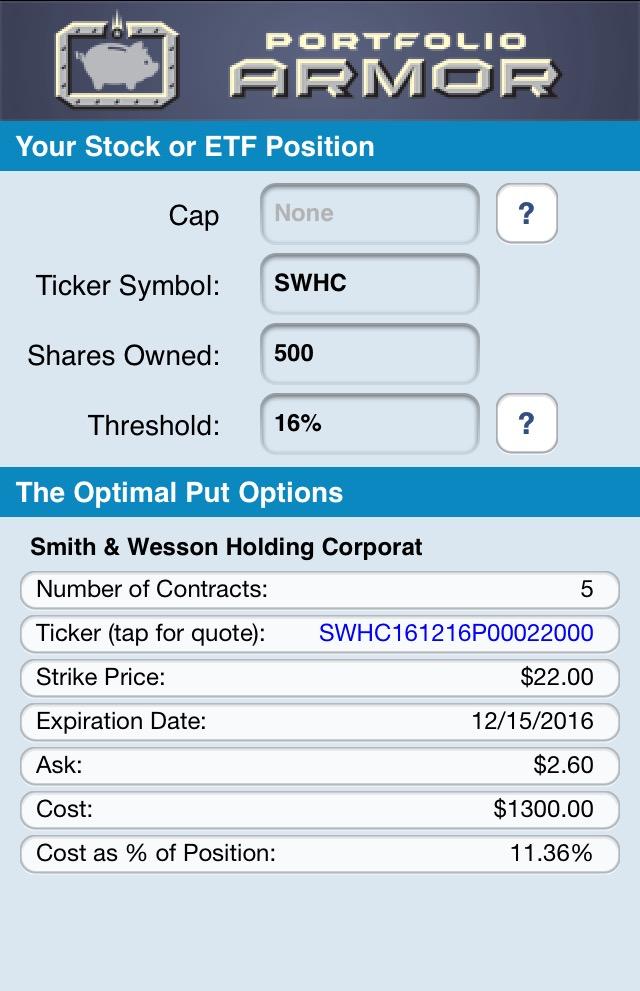

Here are the optimal puts as of Monday’s close to hedge 500 shares of SWHC against a greater than 16% drop by mid-December.

As you can see at the bottom of the screen capture above, the cost of this protection was $1,300, or a steep 11.36% of position value. A few points about this hedge:

- To be conservative, the cost was based on the ask price of the puts. In practice, you can often buy puts for less (at some price between the bid and ask).

- The 16% threshold includes the cost, i.e., in the worst-case scenario, your SWHC position would be down 4.64%, not including the hedging cost.

- The threshold is based on the intrinsic value of the puts, so they may provide more protection than promised if the underlying security declines in the near term, when the puts may still have significant time value.

If you don’t want to spend this much to hedge against a greater than 16% decline over the next several months, you can consider hedging with an optimal collar instead.

Hedging SWHC With An Optimal Collar

When scanning for an optimal collar, you’ll need another figure in addition to your threshold, your “cap,” which refers to the maximum upside you are willing to limit yourself to if the underlying security appreciates significantly. A starting point for the cap is your estimate of how the security will perform over the time period of the hedge. You don’t think the security is going to do better than that anyway, so you’re willing to sell someone else the right to call it away if it does better than that.

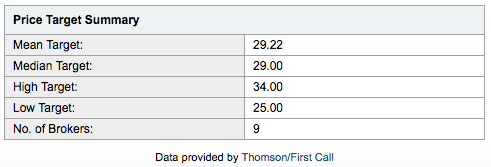

The median Wall Street price target above, via Yahoo Finance, implies a potential return of about 13% for Smith & Wesson over the next 6 months. This was significantly higher the potential return estimated by Portfolio Armor’s website, which was closer to 2%. So we started using 13% as the cap, and when we were able to raise it to 18% without raising the hedging cost, we used that.

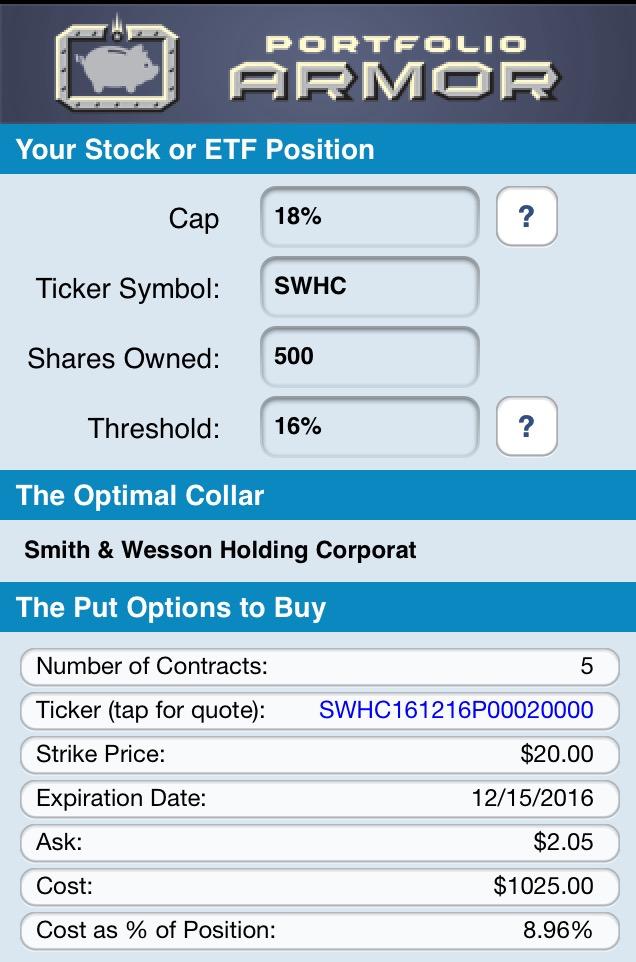

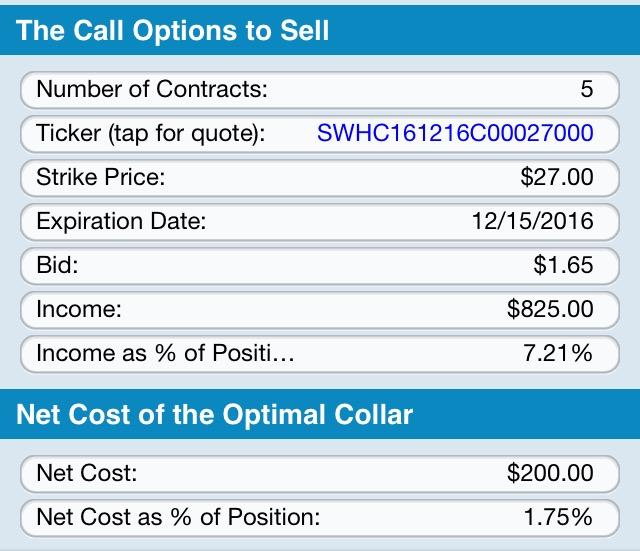

This was the optimal collar, as of Monday’s close, to hedge 500 shares of SWHC against a >16% drop by mid-December, while not capping an investor’s upside at less than 18% by then.

As you can see in the first part of the collar above, the cost of the put leg was $1,025, or 8.96% of position value. But as you can see in the second part of the collar below, the income generated from the call leg was $825, or 7.21% of position value.

So the net cost of this collar was $200, or 1.75% of position value. A couple of notes about this hedge:

- Similar to the situation with the optimal puts, to be conservative, the cost of the optimal collar was calculated using the ask price of the puts and the bid price of the calls. In practice, an investor can often buy puts for less and sell calls for more (again, at some price between the bid and the ask), so in reality, this collar would likely have cost less than $200 to open.

- As with the optimal puts above, this hedge may provide more protection than promised if the underlying security declines in the near future due to time value (for an example of this, see this recent article on hedging Apple). However, if the underlying security spikes in the near future, time value can have the opposite effect, making it costly to exit the position early (for an example of this, see this article on hedging Facebook – Facebook Rewards Cautious Investors Less).