Greetings from CalTrain, where I’m bumping along on the Baby Bullet to visit one of my children’s schools for an end-of-year activity. I have zilch new to say about the “market” right now. Indeed, the one chart I have which neatly expresses my time allocation during recent trading days sums it up:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

That Sorkin Moment

Recently I mentioned how “don’t talk about religion or politics” is usually wise counsel. And, as with most wise counsel, I ignore it. I actually hardly ever discuss religion, actually, because to me it’s something deeply personal, and to hear others talk about their own beliefs is more than a little boring. I get a little riled when one particular religion chops off people’s heads (or burns them alive in cages, or what have you), and I’ve learned to keep my mouth shut about certain religions dominating certain industries. I pretty much leave the topic alone.

Politics, though, is a different matter. I consider it every bit as interesting as charts, because, you see, it’s not stocks or politics I find especially captivating – – – – it’s the history that’s forming around us during our lives.

Swing Trade ZAYO, MA, JNPR, IR, ATI

Poised for a Breakout

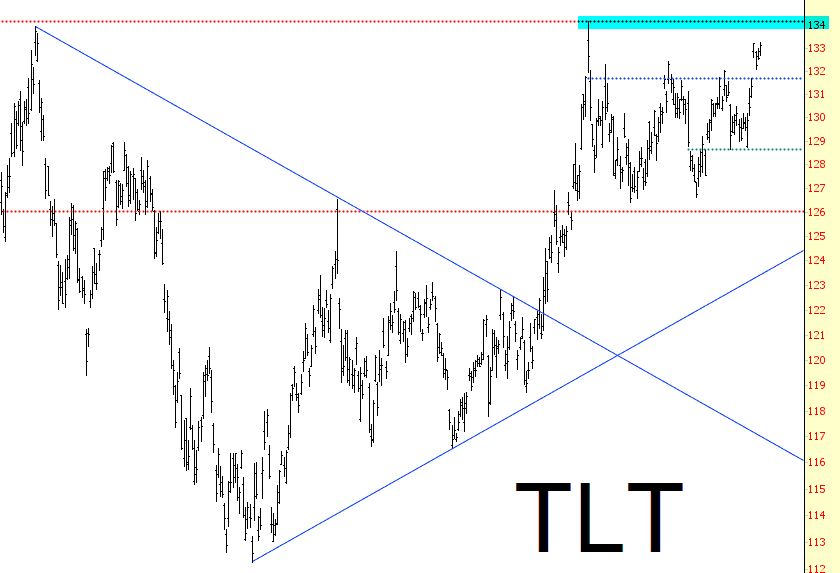

There are a couple elements of this perma-rising market which I actually applaud. One of them is precious metals, which I hope roar to the moon and beyond. The second is bonds. Looking at the chart below, it seems to me the long bond is getting ready to add another leg to its incredibly long-lived bull market. Why people think Yellen might raise rates next week is beyond me. It seems the market believes interest rates are going to hang out near zero for pretty much the rest of our lifetimes.

Watching the Wedges

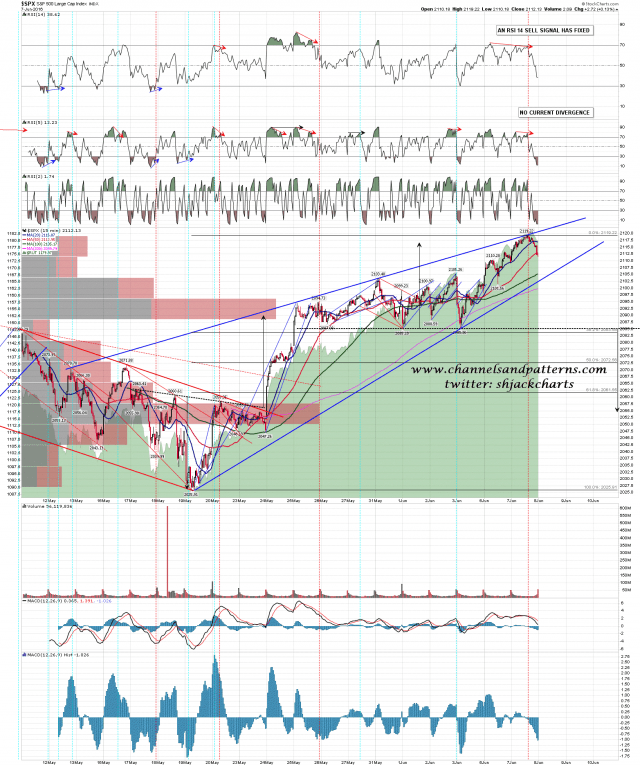

The November 2115 high was broken yesterday and that was a very significant technical break. The open island top gap on NDX hasn’t filled yet, but I’m expecting a retest of the ATH at 2134 SPX sooner rather than later now.

Short term though, I’m still watching the wedges from the last low on SPX and RUT. Both had perfect reversals at wedge resistance yesterday with 15min sell signals fixing afterwards. The obvious next target within the wedges is at wedge support, which closed yesterday on SPX in the 2102 area. I’m watching with great interest to see whether that gets tested this morning and if so, whether there is a strong reversal back up from there. SPX 15min chart: