The November 2115 high was broken yesterday and that was a very significant technical break. The open island top gap on NDX hasn’t filled yet, but I’m expecting a retest of the ATH at 2134 SPX sooner rather than later now.

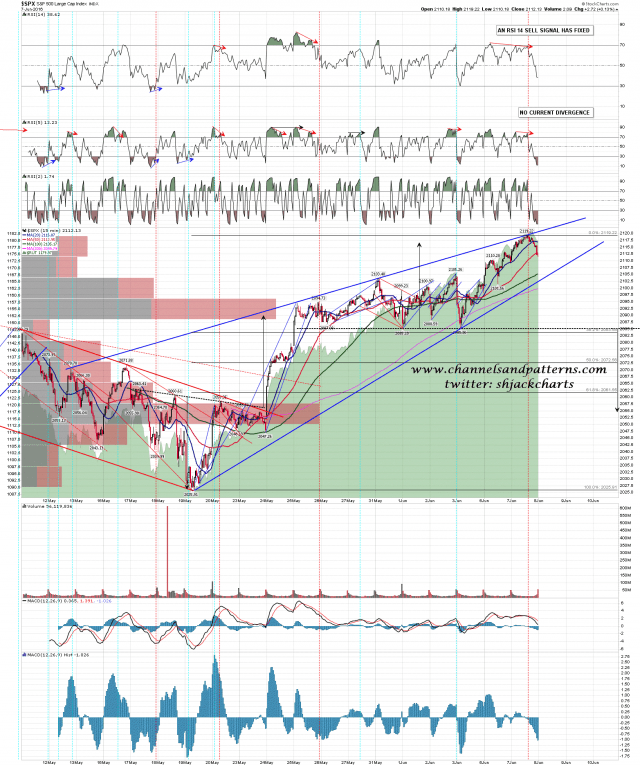

Short term though, I’m still watching the wedges from the last low on SPX and RUT. Both had perfect reversals at wedge resistance yesterday with 15min sell signals fixing afterwards. The obvious next target within the wedges is at wedge support, which closed yesterday on SPX in the 2102 area. I’m watching with great interest to see whether that gets tested this morning and if so, whether there is a strong reversal back up from there. SPX 15min chart:

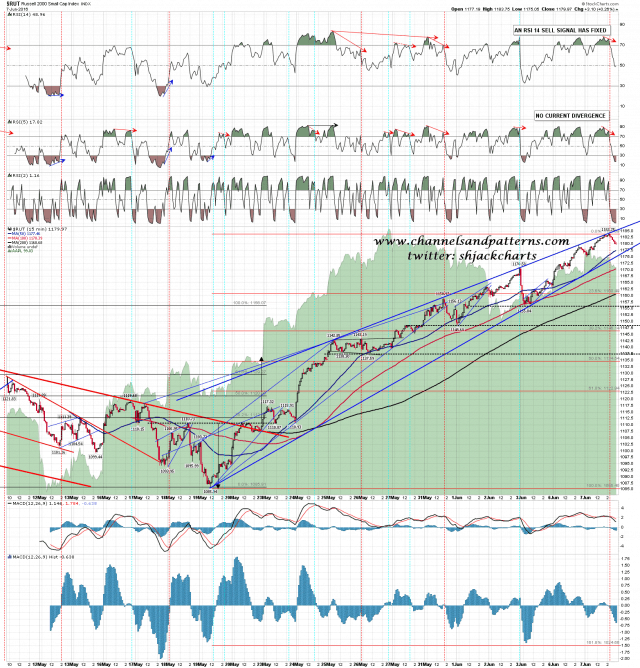

On RUT rising wedge support closed yesterday in the 1175 area. RUT 15min chart:

On ES there is an open 60min sell signal that fixed at the RTH close yesterday. That should be good for a retest of the overnight low at 2106. We’ll see whether it delivers. ES Jun 60min chart:

Why are the wedges important? Well if these wedges are still forming, then regardless of yesterday’s bull break then there should still be a decent chance of a retrace coming soon, particularly if the SPX all time high at 2134 is tested within the SPX wedge. If the wedges are still forming then we should see a test of wedge support before significant further upside on SPX. If SPX and RUT break up hard instead, then a retracement starting soon becomes a lot less likely.