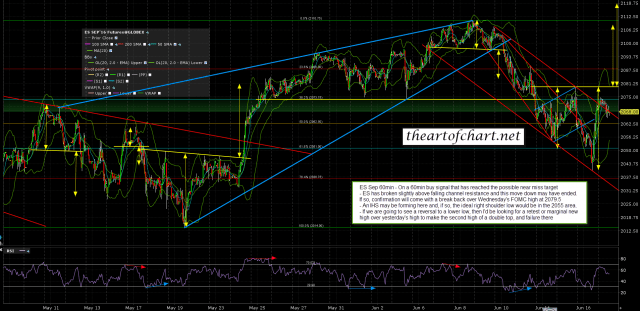

Recently I have gotten wordy about the decline in ‘inflation expectations’ beginning on June 2, right on through yesterday’s update of the TIP-TLT ratio and TLT in essence, attaining their targets. The implication would be that the mini deflation whiff is coming to its limits.

As often happens at potential limit points, the market’s crosscurrents are strong. As noted yesterday, USD, gold, silver and the gold miners all did in-day reversals as items that had been risk ‘off’ got hammered. ‘What, USD and gold in lockstep? What is the meaning of this?!?’ think inflationists. See yesterday’s in-day post Strange Bedfellows.

The meaning is that these items, along with the VIX and US Treasury bonds have been plays for a risk ‘off’ market as it got the jitters over deflation. Gold miners had been, however fleetingly, rising in line with their counter-cyclical fundamentals and this is the mirror image to the reasons why I so often parrot that if you are a gold miner bull, at least realize that fundamentally at least, the sector is done no favors in an inflationary backdrop (price, for long stretches of time, can be something else all together).