Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Mixed Signals or a Clear Path Forward?

[edit] Please see a new post with more perspective on a would-be ‘inflation trade’ and its limitations.

The following excerpt is the opening segment from this week’s edition of Notes From the Rabbit Hole, NFTRH 398…

Last week’s opening paragraph: “If we are going to highlight improving fundamentals, which we did as gold out performed commodities and stock markets, then we also have to highlight and respect eroding fundamentals; no ifs, ands or buts.”

This week’s opening paragraph: If we are going to highlight eroding fundamentals, which we did as gold under performed commodities and stock markets and Semi Equipment made an early positive economic indication, then we also have to highlight and respect improving fundamentals; no ifs, ands or buts.

Gold is about the economy, the market risk profile, implied confidence in policy makers and above all, the state of money and the perceptions of billions of people who hold this ‘money’ issued by governments with “Legal Tender” or other wording to give the holder a feeling of confidence in its origin, its backing.

Swing Trade INTU, QCOM, LVS, BA, TLRD

A Dollar and (My) Two Cents

Quite a Friday we had last week, huh? Upon checking my “End of Week” Charts, I noticed some interesting behaviour and thought I’d share my observations. Last weekend sometime, I shared a weekly chart of the US Dollar and that it was approaching its 20 week MA. I use the 20week and 20day moving averages as basic bull/bear filters. I’m only bullish on stocks that are above both and I’m only bearish on stocks that are below both.

I find this makes for an easy and efficient filter. I thought that the US Dollar had reversed short of the test until I saw it after the close Friday and realized it had tested the 20week MA exactly. Take a look. (click any chart for a larger size version)

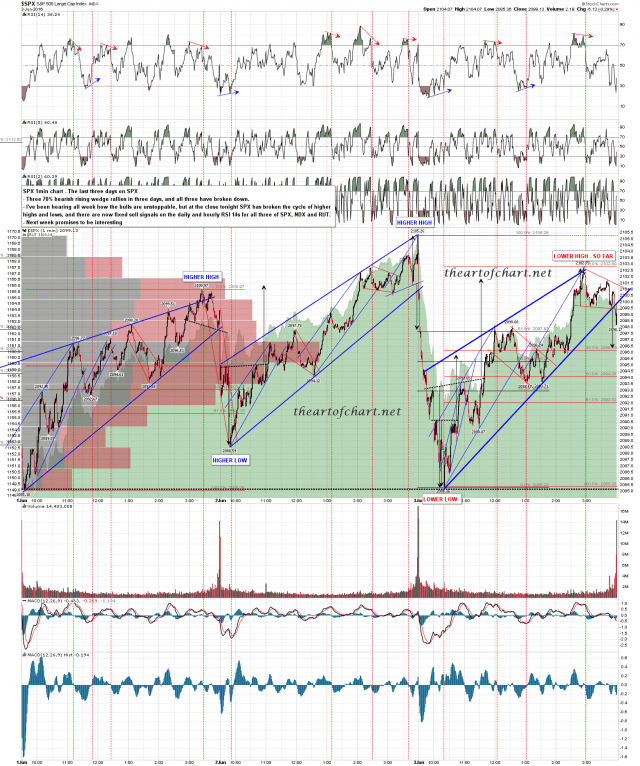

A Moment Of Truth – Day 2

The NFP numbers on Friday morning were a very big miss, with significant revisions down in the April and March numbers as well. All the indices tanked hard but double top support on SPX wasn’t significantly broken and most of the decline was then given back on Friday. That made Friday the third straight day on SPX that started with a decline and the ground up for the rest of the day in a 70% bearish rising wedge. The first two of those broke down hard the following morning. We’ll see how the third one does this morning. SPX 1min chart: