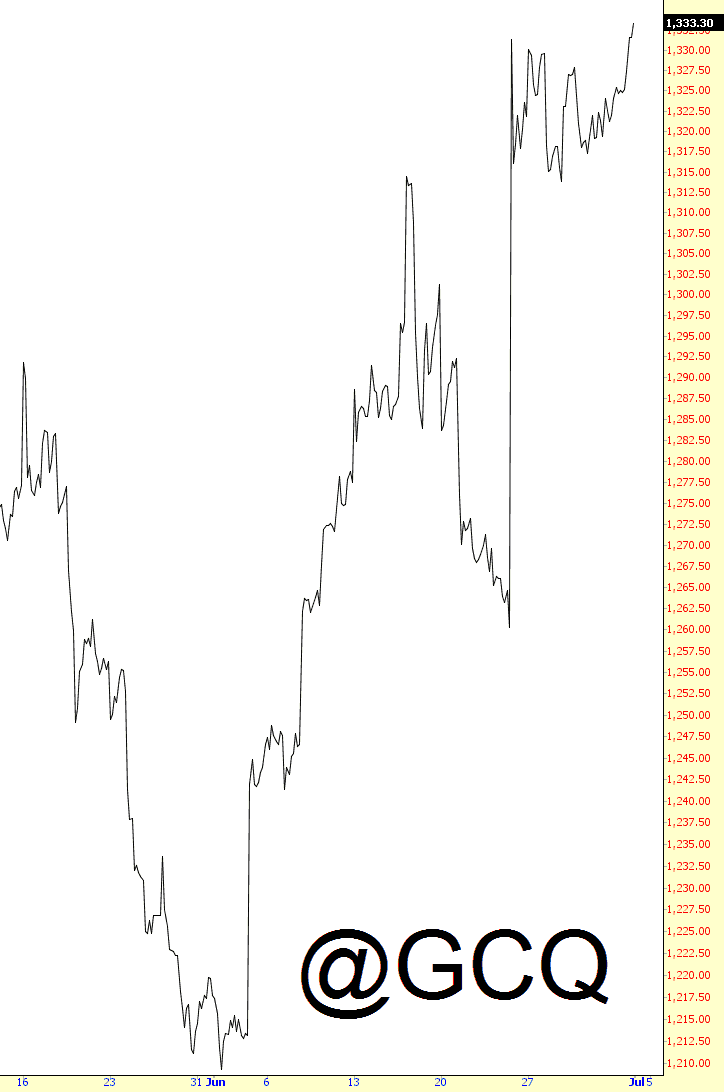

Hear that? It’s the sound of gold. And it’s trying to tell you something that the ES refuses to acknowledge. Pay attention.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

A Path Toward Inflation

Yes, it’s another inflation post going up even as inflation expectations are in the dumper and casino patrons just cannot get enough of Treasury and Government bonds yielding 0%, near 0% and below 0%.

Feel free to tune out the lunatic inflation theories you’ve found at nftrh.com over the last few weeks. But if by chance you do want to look, here’s a visual path we have taken to arrive at the barn door, behind which are all those inflated chickens, roosting and waiting. All sorts of animals will get out of the barn if macro signals activate.

Brexit Never Happened

Wiping the Slate Clean

Since the whole “profiting from the equity bear market” schtick hasn’t really worked for me during the past 7 years, I think I’m going to succumb to the second email I received today (the first of which was posted here) and pivot Slope of Hope to be the first place you think of for your toilet paper needs. To wit:

Retesting The Broken 2085 Floor

This has been a strange few days on SPX. Friday and Monday trended down in a very steep falling wedge, and after that broke up at Monday’s close, SPX has trended up Tuesday and Wednesday in a very steep rising channel. A retracement of some kind today is likely. The patterns from the lows on SPX, NDX and RUT are unsustainably steep, and the historic stats for the last trading day of June are 70% bearish. Bears need to do some damage with that today though as the historic stats for the first day of July are 80% bullish.

Yesterday’s break up through the 5dma put SPX back on the three day rule, and on a close back (at least 2 handles) below the 5dma either today or tomorrow, SPX would then be extremely likely to retest the 1991 low before any retest of the 2120 high. The 5dma closed yesterday at 2051 and I’d be surprised not to see a retest of that today. SPX daily 5dma chart: (more…)