This has been a strange few days on SPX. Friday and Monday trended down in a very steep falling wedge, and after that broke up at Monday’s close, SPX has trended up Tuesday and Wednesday in a very steep rising channel. A retracement of some kind today is likely. The patterns from the lows on SPX, NDX and RUT are unsustainably steep, and the historic stats for the last trading day of June are 70% bearish. Bears need to do some damage with that today though as the historic stats for the first day of July are 80% bullish.

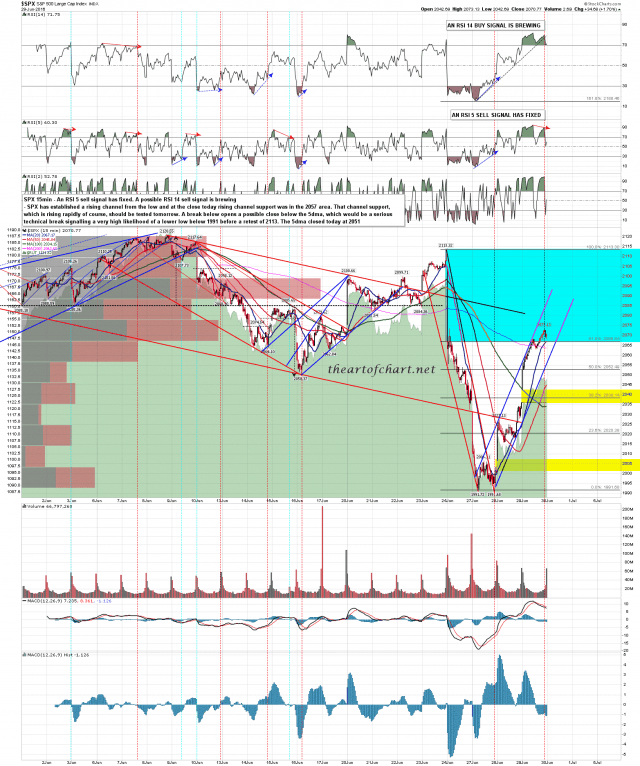

Yesterday’s break up through the 5dma put SPX back on the three day rule, and on a close back (at least 2 handles) below the 5dma either today or tomorrow, SPX would then be extremely likely to retest the 1991 low before any retest of the 2120 high. The 5dma closed yesterday at 2051 and I’d be surprised not to see a retest of that today. SPX daily 5dma chart:

There’s a very decent looking rising channel on SPX from the lows here and channel support is currently in the 2065 area. A break below opens a larger retracement and a test of the 5dma. SPX 15min chart:

NDX in a very nice rising wedge from the low. Support broke slightly after the open today so should be in a topping process. NDX 15min chart:

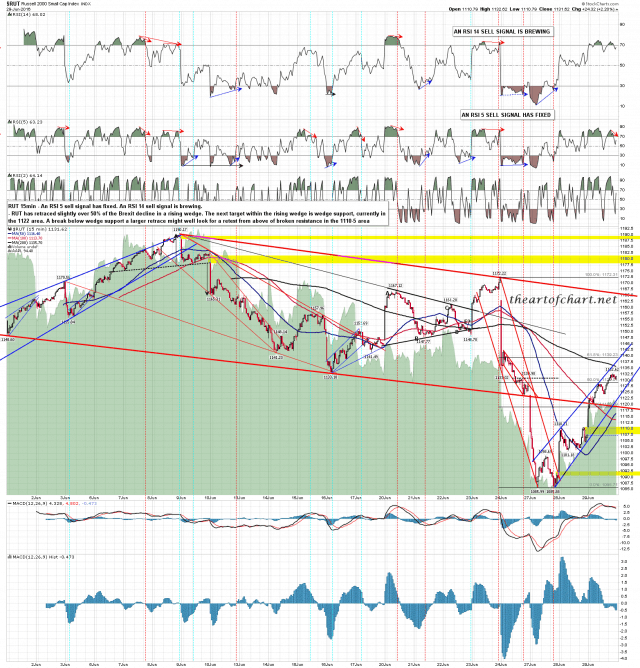

Decent rising wedge from the lows on RUT. Wedge support currently in the 1126 area. RUT 15min chart:

The SPX daily middle band at 2081 is main resistance today and that has been tested as I’ve been writing. Slightly above is the key 2085 level which was the established floor before the Brexit break down and the HOD so far is an exact test of that at 2085.23. On a break above and conversion to support today the bear side are likely finished both today and tomorrow. Support is at the 50 hour MA and the 5dma, currently at 2061 and 2045 respectively.