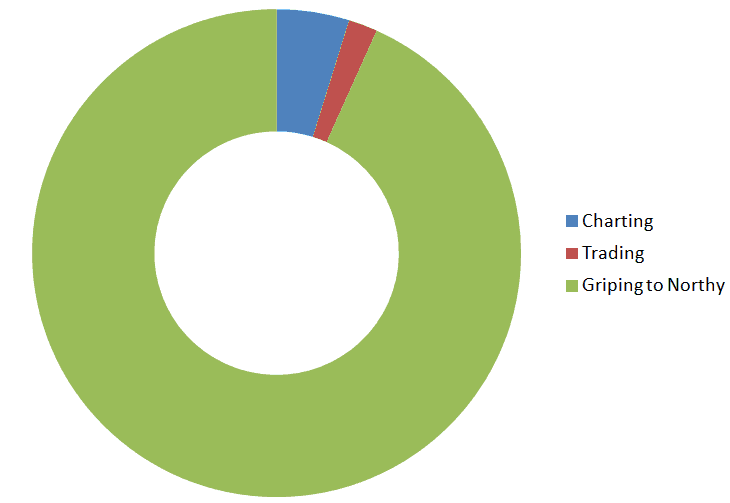

Greetings from CalTrain, where I’m bumping along on the Baby Bullet to visit one of my children’s schools for an end-of-year activity. I have zilch new to say about the “market” right now. Indeed, the one chart I have which neatly expresses my time allocation during recent trading days sums it up:

Indeed, Northman Trader is providing a vital public service, since he gets to put up with my whining and yelping all day long, to the benefit of everyone else who doesn’t.

We suddenly find ourselves living in a world in which Dennis Gartman is right. He said shorts should “run for the hills”. He said he was “bullish of crude oil.” Right on both counts. Surely we have entered some kind of bizarre parallel universe.

Until crude oil stops inching up day by day, the market as a whole is going to stay strong. As far as I can tell, we’re all in a holding pattern (of slightly higher highs every blessed day) until Yellen on Wednesday. My dumb guess is that, after that point, precious metals are going to really start sailing higher, as will bonds, and equities will finally get some weakness.

This train is lurching so violently, I’ll end it here. (And to think they’re considering putting high-speed rail on these tracks; ha!) I’ll see you in the morning.