I’m about to head to the Google campus, as I often do at this God-forsaken hour, to walk my army of canines. It’s a fun place for a dog walk, because they can tear around everywhere and amble through the goofy Google employee goodies (like their baseball case, putting green, volleyball courts, and other production-enhancing stuff) without being bothered by humans.

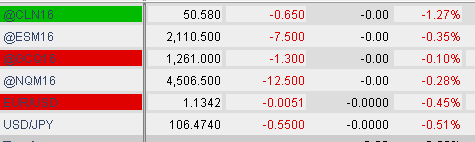

But I was at least glad to see, for once, a little red on the screen.

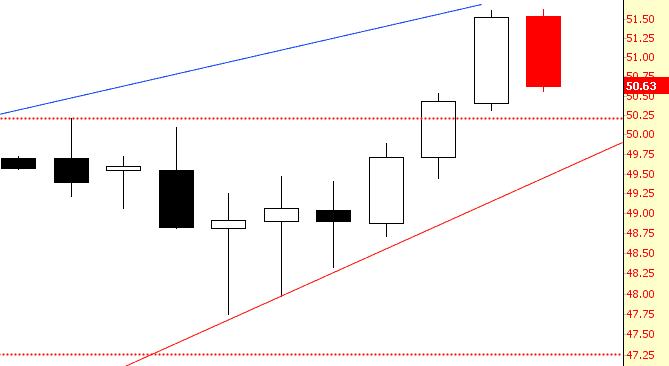

Indeed, crude oil, which has been my nemesis for months now, is finally getting some selling. Nothing to celebrate yet, but breaking that red line (and, even better, breaking below 50) would cause a lot of oil bulls to start thinking about taking those profits off the table.

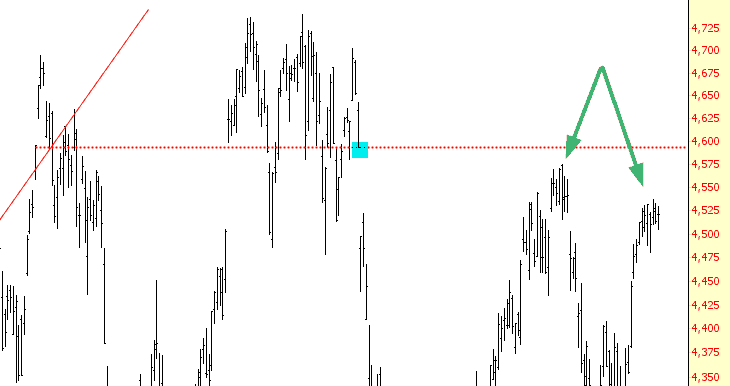

See, if I had been kidnapped by aliens in 2009 and was just dropped back to Earth to look at charts, I would look at the multi-decade double-top we’re facing on the NASDAQ and conclude that, oh, putting one’s entire portfolio into October index puts would be a pretty shrewd idea. As I keep saying these days, someone is going to make a fortune off this collapse. It just ain’t gonna be me. My spirit’s too busted.

Looking closer, you can see what’s happening: a fantastic gap down (cyan tint), followed by that wonderful early 2016 plunge, only to be followed by the not-so-wonderful recovery. The recovery just about perfectly closed the gap and started to re-weaken. It then began another annoying recovery, but look at what’s happening now: it isn’t even able to muster its way back to the gap. There’s a lack of internal strength. If we poop out here, I think you’re going to see us gain momentum to the downside, at long last.

Well, these dogs aren’t going to walk themselves, you know. I will consider it some kind of miracle if we close red today, because the entire market has been trained to buy the dip in the first half hour of trading and just bid stocks up all day long. We’ll see. A red close would sure boost my interest in this mess, though.