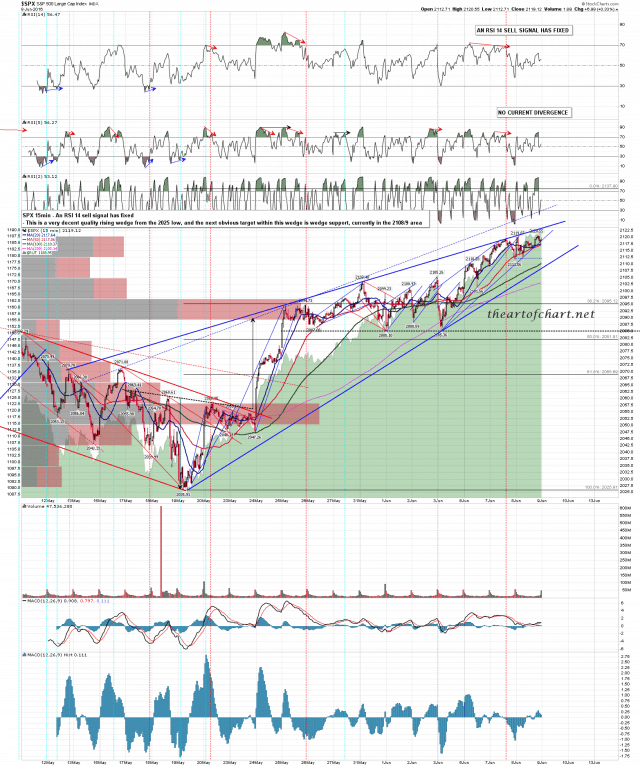

We didn’t see a support test on either of the SPX or RUT wedges yesterday. SPX made a new swing high under wedge resistance and RUT overthrew that resistance slightly. SPX has come close to a test of wedge support at the open this morning, but needs just a little lower to hit it. SPX 15min chart:

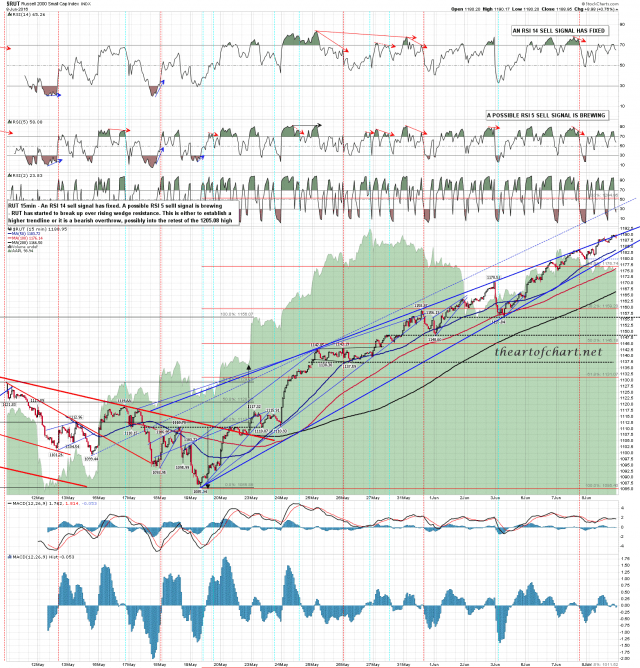

After yesterday’s bearish overthrow RUT has broken wedge support this morning. This puts RUT in a likely topping process and means that a short term high should be close. RUT 15min chart:

If we have already made the short term high, then ES should tell the story. Support is at yesterday’s low at 2106.5 and rising support is in the 2105 area. On a break below both the double top target would be in the 2093/4 area, just under the weekly pivot at 2095.7. ES Jun 60min chart:

This uptrend is fragile, with a lot of negative RSI divergence across multiple timeframes. I’d like to see a new all time high on SPX before the next retracement, but the uptrend may fail below that and there are at least some signs that it will. We’ll see how that goes today.