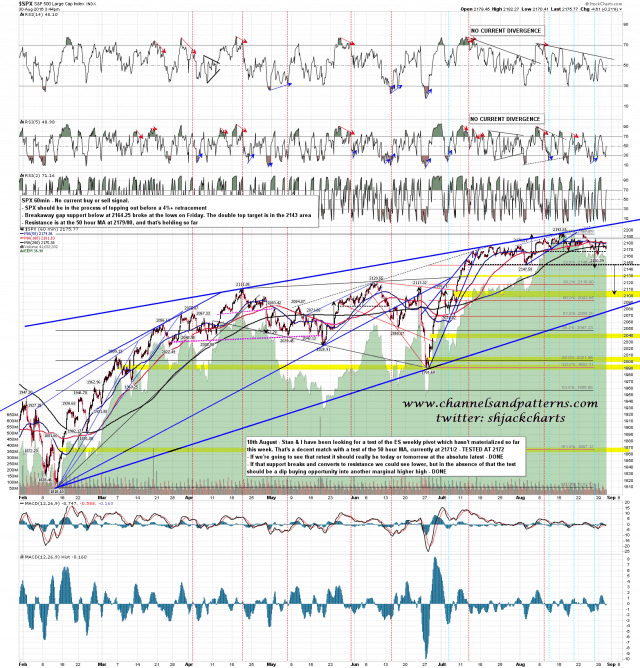

I’m having a theme of latin post titles so far this week, though I’m sure that some of you will know that unlike the last two, the sentence I’m using as the title today is joke latin rather than the real variety, and I’m using it as a description of what we have been seeing on equities here as bears waste their window of opportunity to deliver a correction in price here rather than just a correction in time.

It has been a while since I last posted here the bonus charts that I do every day for Daily Video Service subscribers at theartofchart.net on various futures every night (with update notes before the RTH open the next day). Given that equities seem so determined to be boring here, this is a good opportunity to show how interesting everything else is looking. I’ve added the overnight updates as well.