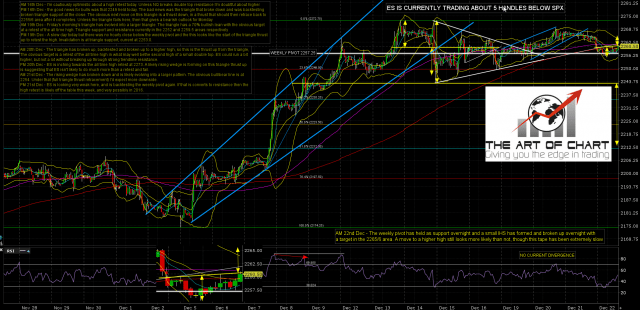

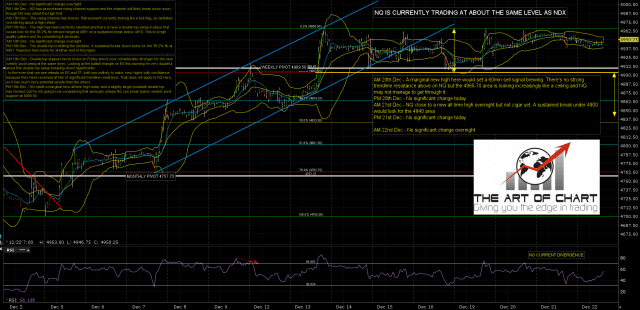

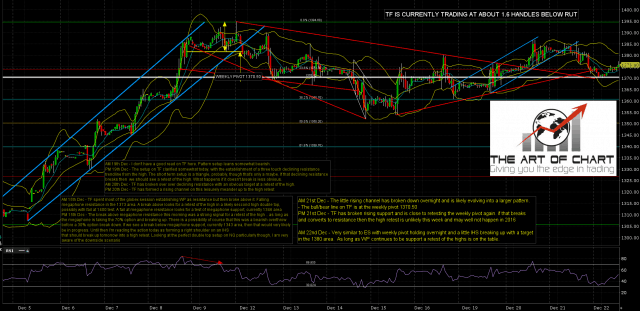

The tape is low volume and has been pretty dull this week on indexes, particularly on NDX/NQ. Volume is unlikely to increase much before next week and the tape may well remain boring, though at the time of writing ES and TF are making a spirited attempt at converted the weekly pivots there to resistance, and if that attempt is successful then this might get more interesting, though it might just establish a tape just as boring with a different underlying bias.

Until we see ES and TF convert their weekly pivots to resistance my overall lean is towards seeing retests of the all time highs. Even in that case I’d note that the downside targets on ES and TF to establish ideal bull flag channels (to then retest the all time highs) would currently be in the 2238 and 1345 areas respectively. On weekly pivot conversions today then those (moving) targets would be the obvious next targets. If the indices head there then that move might be just as dull. I tweeted my premarket video today looking at the setups on ES, NQ, TF, DX, CL, NG, GC & ZB. As usual the indices were among the least interesting looking instruments to trade today. You can see that video here.

ES Mar 60min chart:

NQ Mar 60min chart:

TF Mar 60min chart:

I haven’t mentioned the offer that we are running this week at theartofchart.net for discounted annual memberships as it’s mainly to allow existing subscribers to lock in long term lower subscription prices, but it is available to anyone, so I should mention it here. We usually give two months free on all annual memberships but on annual subscriptions made through December 26th we are giving an extra 20% discount using the discount code shown on this page here.

As I am finishing this post ES is testing support at the 2254 bull/bear line I gave a couple of days ago. If that breaks with any force then the odds of reaching the flag channel targets I gave above are high in my view. What happens at this inflection point likely decides the day today.