I hope everyone had as relaxing a weekend as I did. I had a very relaxing holiday weekend, though we’ve now reached the usual point of starting to clear up and looking dubiously at the mountains of leftovers.

I did a premarket video this morning and posted that on my twitter before the open. If you missed that you can see that here. I do these as part of our Daily Video Service at theartofchart.net with premarket charts, and updated charts in the evening. Stan does a video after the close. If you’re interested in trying the service we do a two week free trial and you can find that here. We’ve now posted our ‘Twelve Trades of Christmas’ this year for subscribers only. Last year we scored a 75% win rate though we’re not expecting to manage that every year. We’ll be posting the results for this year’s trades in March.

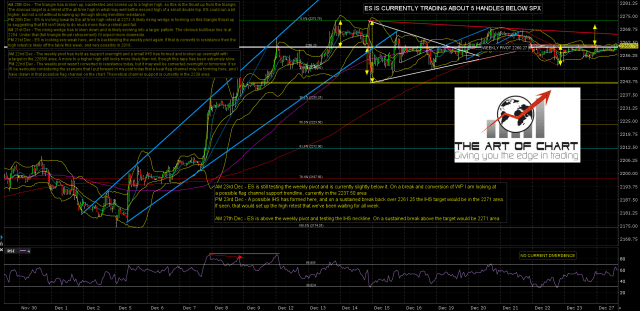

I posted the ES chart (for subscribers) on Friday night looking at a possible IHS with a target at 2271. Obviously that’s looking pretty good so far. ES Mar 60min chart:

I mentioned on the NQ chart that the longer NQ failed to break down through clear double top support, the more likely it was that there was unfinished business above, and NQ has delivered a new ATH since the open. NQ Mar 60min chart:

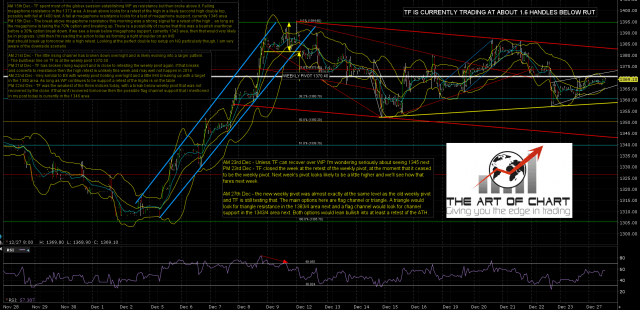

TF is close to a test of possible triangle resistance at 1383.2 area. TF Mar 60min chart:

I’m not really expecting to see much of interest this week. I’m leaning long into a retest of the ATH on SPX/ES unless we see the weekly pivot at 2260 broken and converted to support. Volume and interest are likely to be low all week.