Greetings from the Knight household, as each member of my beloved family is doing their own thing. Me? I’m composing you a post for absolutely no charge. I’m a helluva guy, aren’t I? Let’s begin our story.

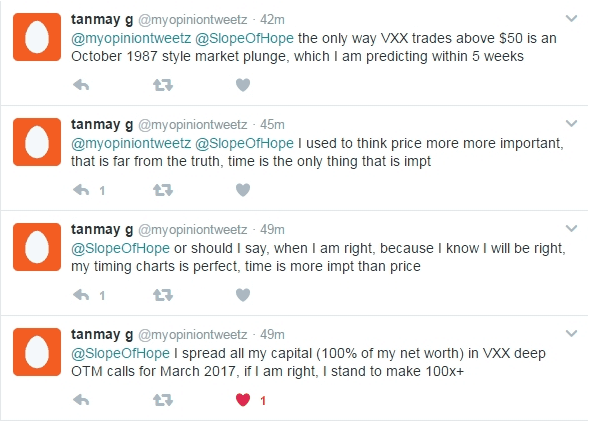

About a week ago, I got a series of tweets from a fellow whom I don’t know and have never heard about. He wanted me to know about a big bet he was making………..

So just to boil this down for you……..this fellow claims to have put 100% of his net worth (not just trading capital………but net worth) into March 2017 VXX $50 calls. Allow me to show you the VXX, and see if you can divine its trend from the chart. I have, as a point of reference, marked where the $50 strike price is.

I took a look at the history of the VXX, and the most explosive up-move I could find was the late summer 2011 debt crisis, in which the VXX went up over twice its value over a period of about nine weeks. Considering how far $50 is from present price levels, I’m not even sure it’s mathematically possible, no matter how tremendous a crash, to get above $50. Indeed, I think there’s a greater likelihood that the Janet Yellen Leaked Sex Tape will win the Academy Award for Picture of the Year in 2017.

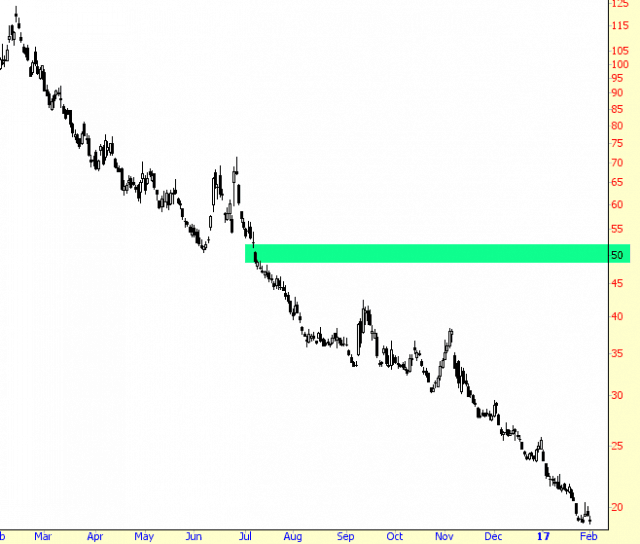

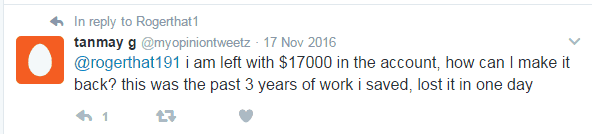

Now, I was naturally curious if this same fellow had a track record I could examine. He didn’t have very many tweets, and there was only one other clear trade he had made.

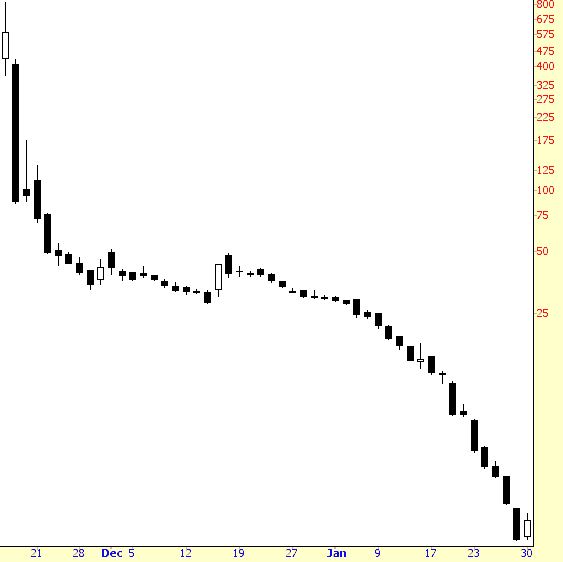

So apparently he put hundreds of thousands of dollars into DRYS around November 16th. Here again, let me show you that chart around the relevant time:

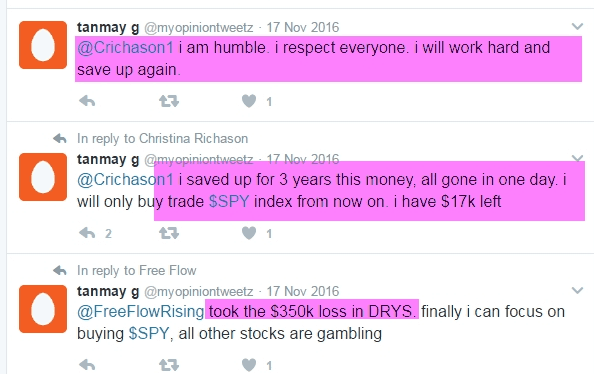

So after that debacle, our hero was chagrined and humbled:

So, keep in mind, the amount “left” is $17,000. That’s how much survived the DRYS debacle. We’ll get back to this guy later.

I was reminded of this when I read this story in MarketWatch about a fellow who supposedly put his life savings into a very aggressive options play based on AAPL earnings that took place after the close on Tuesday. As I dug deeper into this, I found out the guy’s story was that:

(1) He had inherited $2.5 million from a relative;

(2) He spent the last two years pretty much screwing up in every possible way he could by trading and gambling the money away with reckless bets;

(3) He was so distraught at having only about $350,000 left that he went “all in” with what he had left, wanting desperately to recapture the millions he had squandered. He wrote the item below, which is long and fascinating, and I encourage you to at least skim it:

Well, this is it: Going All-in. My last stand. My final Yolo. $2M-5M possible payoff. (NASDAQ:AAPL)

by inwallstreetbets

I could just about write a book on the post above, since it’s packed with contradictions, fallacies, self-delusion, and obvious signs of gambling addiction. (Added to which, I strongly suspect that God doesn’t hang out reading posts on reddit, so he probably didn’t see the pleadings of this fellow).

I guess I don’t have to tell you where things wound up, but………..

Yep, a video of a guy in total turmoil, including vomiting! Pretty pathetic, isn’t it?

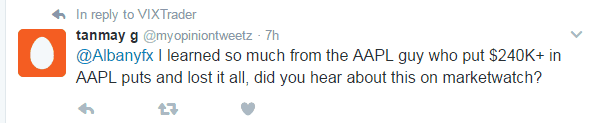

Evidently the guy who tweeted me last week saw this too and remarked……..

Umm, learned what exactly? That you two are exactly alike?

Now a few of you might have already heard this tale about the AAPL guy, and many have declared it “fake” and “gay” (those are the two words most frequently mentioned). To me, I actually think it’s real, because I have no idea what any person would have to gain from going to all this trouble to fake out everyone. He has nothing to gain from it………..not even a small amount of fame, since he wears a wolf mask the entire time!

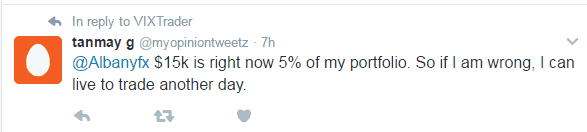

Oh, and as far as the guy who wrote me, do you remember how he claimed to have only $17,000 left and how he was putting 100% of his net worth into those crazy VXX calls? Well look at this:

So now it’s five percent. Sniff sniff. Do you smell something? I sure do.

Anyway, the lesson is simple. Only put a tiny percentage of your portfolio into any particular bet. And don’t be a fucking retard.