Note from Tim: our own Davis Ramsey was kind enough to compose this breakdown of his trading performance. I’d say he’s got Gartman beat!

Conducting a thorough year end review of your trading results is of the utmost importance. While regular monthly reviews are good snapshots and can keep you on the right track, looking back over a full year can show you some important big picture mistakes or successes that you might otherwise overlook.

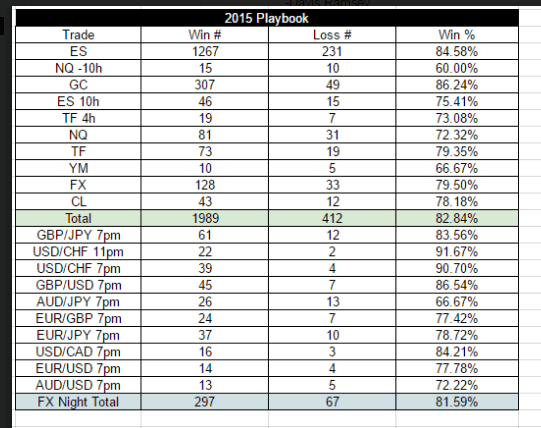

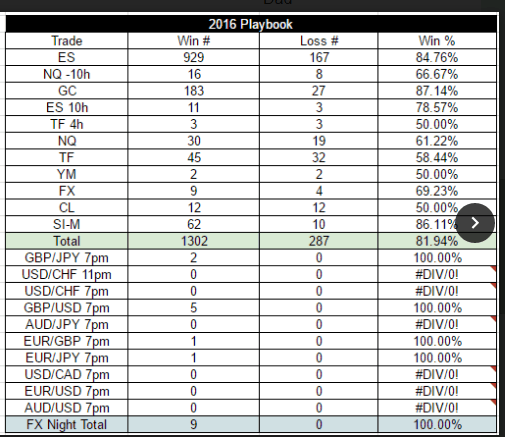

On the surface, 2016 Nadex results were not so different from 2015. My win rate was pretty consistent in my most traded instruments despite bumping up my size by 2.5x from the previous year, which is good to see. One obvious problem was that towards the end of the year, I started doing more 1:1 risk/reward trades that I was just lumping in with the other 4+:1 r/r trades. If you’re familiar with the lingo, I was doing more 50/50 at the money’s instead of the usual premium capture buying 90 or selling 10.

Now I was pretty confident this new approach was working, but I needed to adjust my tracking sheet so I could break down the results better. Otherwise my data would start telling me something that may not necessarily be true.

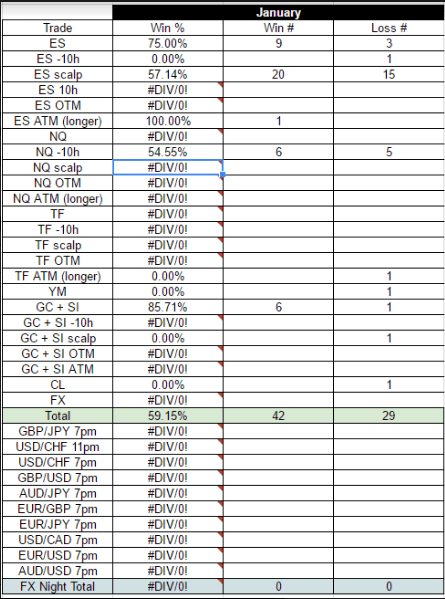

I really hate making things more complicated than they need to be – I think the simpler you can make your trading journal, the more useful it will be. On the other hand, saying I have an 84% win rate on ES but represented in that number are many different risk/reward trade setups, that 84% becomes meaningless. Depending on the underlying trade parameters, 84% could be crushing it or even a net losing strategy. The trade off is I won’t have enough trades per month to see any meaningful trends most likely, but at least I will be able to see what has been working and not working recently a lot more clearly now.

As an aside, I took a pretty good 60% loss over the course of 3 days at the beginning of 2017. I reduced size per my rules to protect against a catastrophic loss and am currently working it back up to full size one day at a time. So January was my lowest overall win % and biggest losing month ever – not the best way to start a new year. But, still a very long time to go and most important is that though I did a couple massive tilt trades, ultimately I did stop myself and lived to fight another day without having to deposit money.

It is very difficult to cut size and know it will take weeks/months to build it back up following my usual daily profit/loss guidelines. Once you can overcome that, you may find that such a journey is actually a great benefit. I took a similar hit in June last year, built it back up by the end of August, and had a great run into year end. Sometimes you have to be reminded that the rules I created were done so for a reason, and not following them is detrimental to long term performance.

Hopefully everyone had a good 2016 and has already completed their year end reviews – if not, you may be missing out on a big personal edge