I was aghast this week when I read that Trump was going to torpedo the Dodd-Frank regulations. As a people, we learned precious little from the sins that led up to the financial crisis. Famously, not a single person went to jail, and over the past eight years of “healing”, the bankers have simply become richer……..and richer……….and richer. The icing on the cake just came, with the feeble regulations that were enacted to reign them in being sent to the chopping block.

It got me thinking to the last time the government torpedoed well-meaning bank regulations, and that was with the the passing of the Gramm-Leach-Bliley act. This act of Congress, which torched the Glass-Steagall law, established a foundation for the financial crisis that would take place years later.

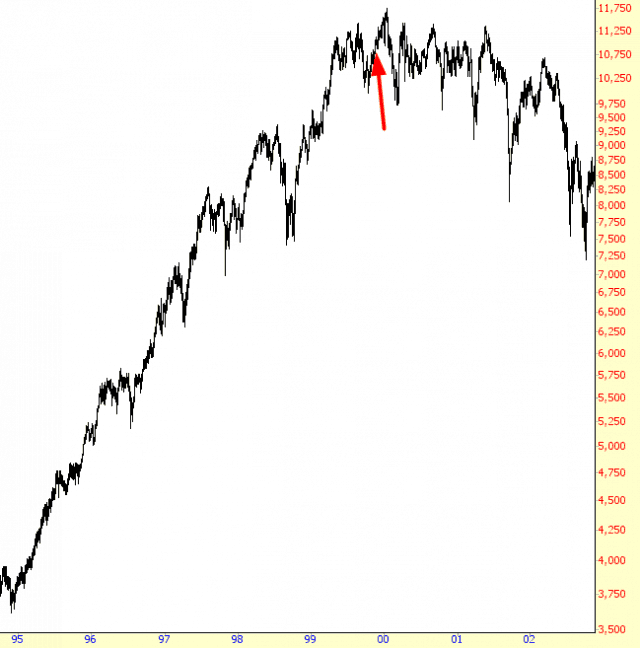

I was wondering to myself, however, how the market embraced the “good” news of deregulation, particularly since these days there is tremendous optimism that Trump’s destruction of all rules, environmental or otherwise, is going to herald in yet another massive leg-up in the bull market. As a point of reference, I’ve put an arrow on the point in the Dow 30 Industrials where the Gramm-Leach bill was passed.

Look, things still look really bad for equity bears. But I at least wanted to get across the fact that the gutting of deregulation doesn’t necessarily herald the beginning of a glorious new age of bull profits. On the contrary, it can sometimes act as its coda.