SPX resolved higher yesterday and the cycle trend day delivered a unidirectional day dominated by the bulls, though not making any new speed records of course. Today is the other cycle trend day this week but as yesterday’s cycle trend day delivered, that less likely to deliver today, and the day has been a two way trade so far.

SPX delivered strong closing breaks above the important resistance levels yesterday and at the time of writing they are the 5dma at 2379-80, the 50 hour MA at 2387/8, and the daily middle band at 2390.

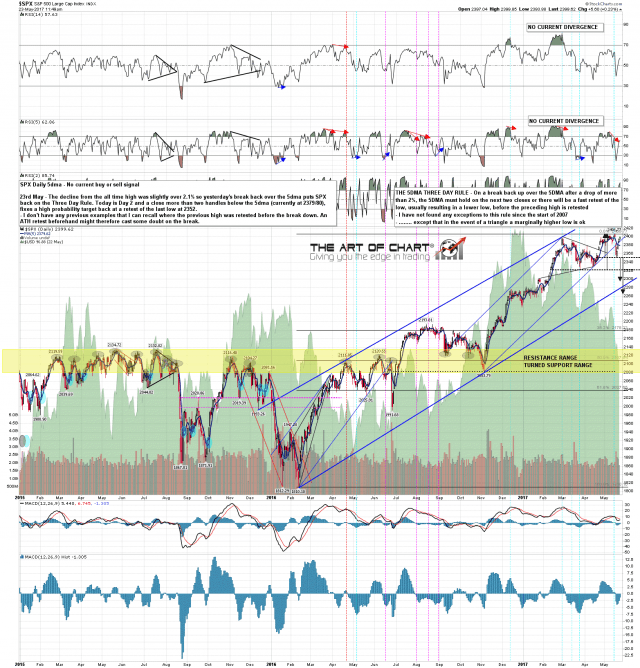

The break over the daily middle band requires confirmation with a close above it again today, and as the decline into 2352 was a shade over 2.1%, the break back over the 5dma puts SPX back on the three day rule, which is that on a break back (more than two handles) below the 5dma today or tomorrow looks for a retest of the last low at 2352 before a retest of the last high at 2405. If we were to see that high retest before the break back below the 5dma that would be strange however, and out of the dozens of these breaks over the last ten years I can’t recall that happening before. If we see that break after an ATH retest on SPX that might raise a question mark over the break, though SPX would likely make that target in any case. SPX daily 5dma chart:

The ES and NQ futures charts below were done before the open for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

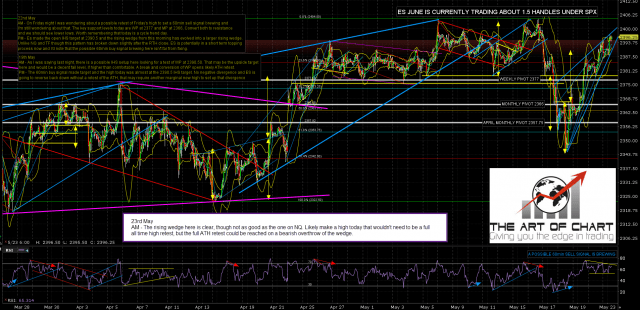

ES made the low at rising wedge support this morning and rallied back to wedge resistance this afternoon. Wedge support is currently in the 2393.75 area and that is the obvious next short term target. On the bigger picture these wedges break down 70% of the time and the 60min sell signal that is brewing is suggesting strongly that this one will break down too. ES Jun 60min chart:

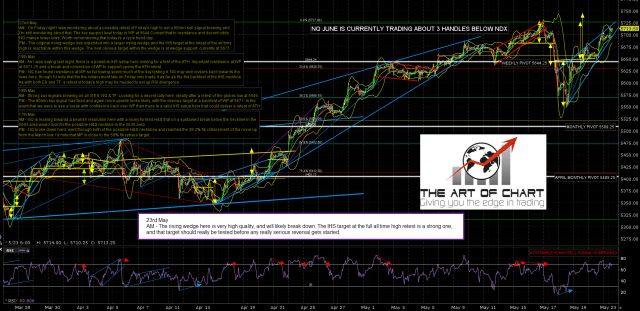

The higher quality rising wedge is on NQ, and rising wedge support was broken at the low this morning. The possible 60min sell signal on NQ also fixed this morning so NQ is likely in a topping process. That could involve a retest of the high but it seems more likely that NQ is forming an H&S right shoulder here that would have an ideal high in the 5706 area. If NQ rallies back to that area, another leg down may well start there. I’d note that I have an IHS target on NQ at a full retest of the all time high and that target has not yet been reached. That target may still need to be reached. NQ Jun 60min chart:

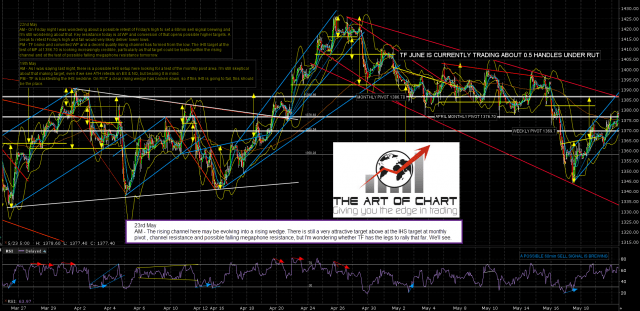

I also have an IHS target not yet reached on TF at 1385/6, though that target area is most compelling on a test today. Like ES a 60min sell signal is brewing but not yet fixed, and like NQ the rising channel broke down at the low this morning. TF Jun 60min chart:

I called a possible swing high at the 2399.50 ES high this afternoon. That’s not an ideal setup but very possible. We’ll see whether indices can manage higher. Possible unfinished business above at the ATh retest on NQ and 1385/6 on TF.

Stan and I are doing a free public webinar at theartofchart.net an hour after the close on Thursday on Trader Psychology in the second of our Managing Risk webinars, and if you’d like to attend then you can register for that on our May Free Webinars page. The video for last week’s Big Five webinar is also posted there. I would also note that this week’s edition of The Weekly Call is posted and that the model portfolio there is up 178% over the last six months, looking well on course to make our target minimum 200% return over the first year. As and when that target is reached we’re thinking of making the strategy there a bit less conservative. That’s a free weekly service and if you trade futures I’d suggest adding it to your reading list.

An old trading friend died yesterday and I want to take a moment to remember a good man and very talented analyst, William Blount who worked out of the Mr Topstep site for the last few years. He was kind and generous enough with his time to teach myself and others a lot about trading ES in the couple of years we spent trading together. He gave just as impressive an example in his death as he did in his life, living more than his due three score and ten years, producing excellent work up until his last day, and then dying suddenly with no extended illness or pain. I hope to be fortunate enough to follow suit on all three counts in due course. Bill will be missed by his many friends and colleagues over the years and I am confident that his funeral will be a great deal better attended than mine is likely to be, unless I start to get out a lot more often. The world is a poorer place for his absence, which is something we should all aspire to as a hard earned and worthwhile epitaph. A life well and fully lived. I will be raising a glass with (unusually) something alcoholic in it to him in remembrance soon. Godspeed to you Bill.