Fellow Slopers may recall I wrote about the hedged portfolio method a few years back. The basic idea was to find securities that had high expected returns over the next six months and were also relatively cheap to hedge, and then to buy and hedge a handful of those names every six months.

I backtested the approach a couple of years ago, and wrote it about here at the time (Does Hedged Investing Work?). You can also find interactive versions of those backtests on the Portfolio Armor website. Since April though, I’ve been tracking the performance of portfolios posted in real time. I wrote about the performance of some of those early portfolios here. Since June the beginning of June, I’ve been creating a few portfolios each week. Here’s how the first cohort of them performed from June 1st to December 1st.

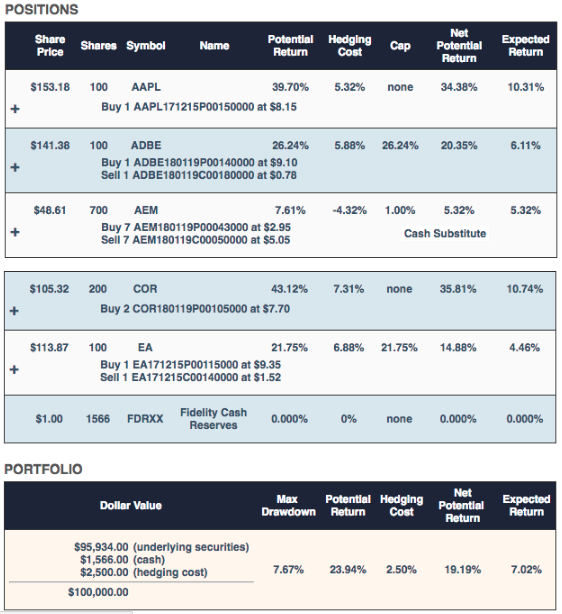

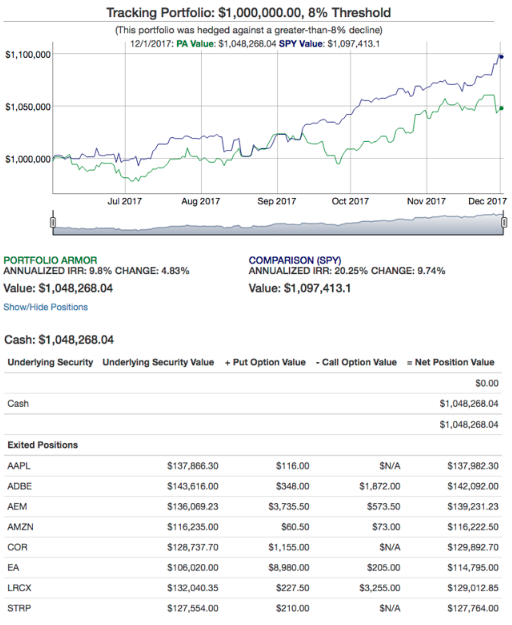

Portfolio 1

The worst case scenario for this portfolio was a decline of 7.67% (the “Max Drawdown”), the best case scenario was a gain of 19.19% (the “Net Potential Return”, or potential return net of hedging cost), and our system’s ballpark estimate of how it would do, taking into account the historic relationship between actual returns and our potential return estimates, was 7.02% (the “Expected Return”).

To be conservative, the hedges in this portfolio and the rest assume you buy the puts at the ask and sell the calls at the bid.

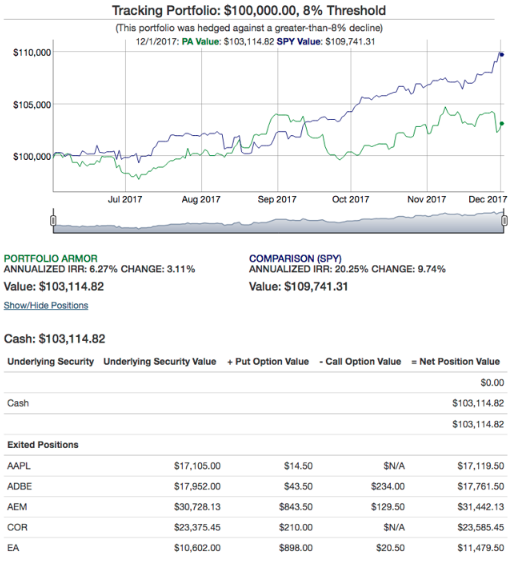

Here’s how it actually did, net of hedging and trading costs:

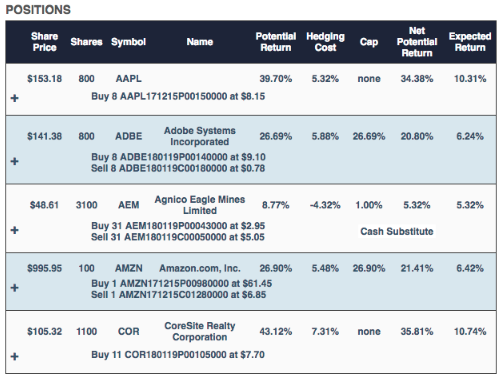

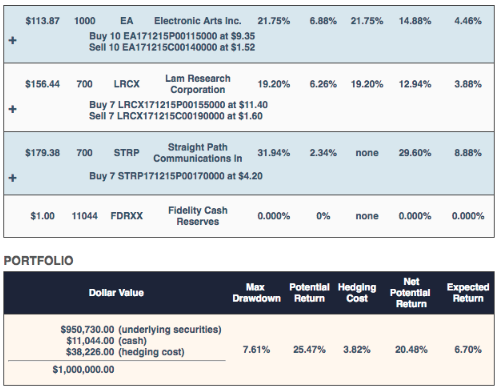

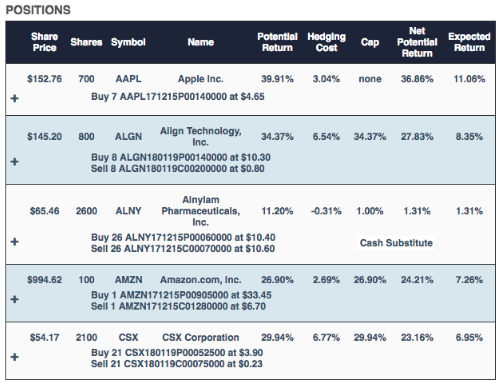

Portfolio 2

With this one, the worst case scenario was 7.61%, best case scenario was 20.48%, and the more likely scenario was in the ballpark of 6.7%. Here’s how it actually performed:

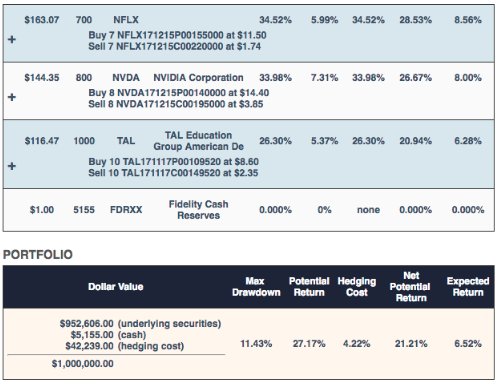

Portfolio 3

As you can see, this one had a higher risk: a Max Drawdown of 11.43%, with a best-case scenario of 21.21%, and an Expected Return estimate of 6.52%. Here’s how it actually performed:

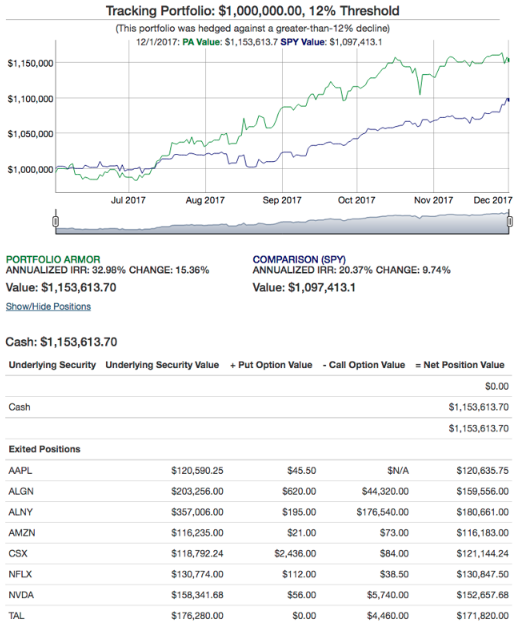

Higher Risk, Higher Returns – But Why?

You’re probably not surprised to see that the portfolio that took on higher risk generated higher returns, but you may be surprised to see why.

Had you not seen the underlying securities in it, you might have guessed it outperformed because it had a lower hedging cost. That would have been a reasonable guess: all else equal, it costs less to hedge when you are willing to risk a larger decline, and all else equal, lower hedging costs mean higher returns.

But all else wasn’t equal, and this portfolio actually had a higher hedging cost (4.22%) than the two portfolios we presented to our subscribers that week (2.5% and 3.22%, respectively). The difference here was security selection. Because the portfolio was hedged against a higher decline threshold, it was able to include top names at the time, including ones such as TAL and NVDA that were too expensive to hedge against >8% decline thresholds.