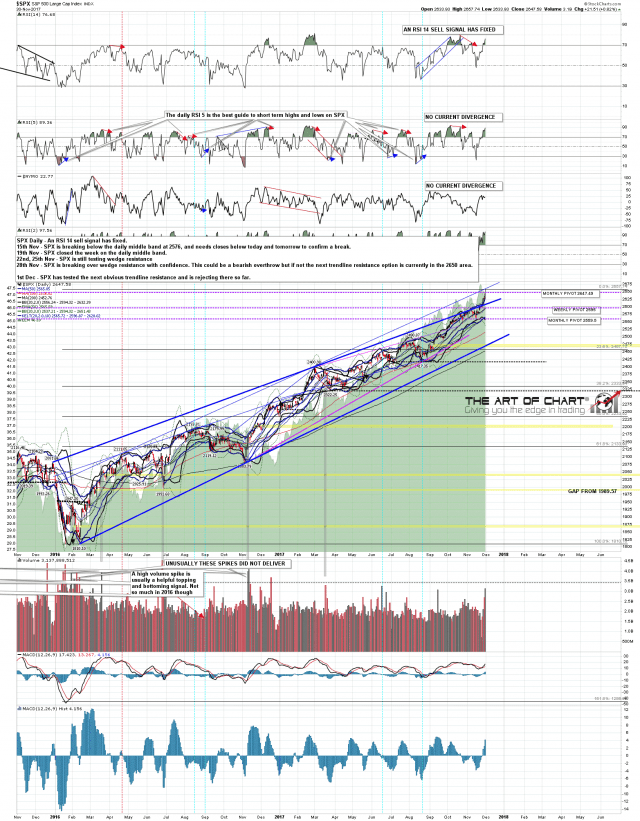

Here are a few global ETFs with little room to drop in order to avoid daily chart technical breakdowns. That does not mean the end of the larger up trends, but could signal oncoming intermediate corrections if they do fall further and close the week that way (pre-market is red). The question would be, are they leading the fiscally drunk US market and its chronic tweeter in chief/stock pumper?

The Euro hedged European iShares, like the Euro STOXX 50 which it mimics, is in a bear flag. The biggest volume days have been red as this flag has ground upward. Not a short-term bullish look for Europe. What it does have going for it is that the SMAs 50 & 200 are both sloping upward. Even a hit of the 200 is within the context of the up trend.