And here I present to you without further comment the entire history – – only in its fourth day – – of BTC as a futures financial instrument. Down 30% and counting.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Circle of Life

One of my favorite coffee table books is an anniversary retrospective of Saturday Night Live over the decades. In the volume is a picture of all the big-shots around the writer’s table. During each week, they all gather for a table read – – Lorne Michaels, the week’s host, the head writers, and the regular cast members. This isn’t the picture shown in the book, but it shows a similar table read during a different week than the one portrayed:

The specific photo in the book was during the week in which Alec Baldwin and Kim Basinger were the co-hosts. It must have been around 1993 or so. (more…)

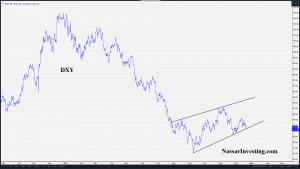

What’s The Next Step For USD DXY?

Looking at the larger structure of the US Dollar, I think it is pretty clear to me that we are in a constructive structure meaning this is only a back test before the next move into the 80’s. The dollar seems to be trading in a bear flag if you look at the 4H below.

Nice, Stable, Boring Utility Stock

Breakout Charts to Watch

Here are four stocks showing strong technical momentum.

BlackBerry Limited (BB) shot up out of a double-top pattern on Wednesday, closing up nearly 12% at $12.17 on 29 million shares traded. That was the largest volume since the end of September, and more than 7x the stock’s daily average. The move came with the company’s positive earnings announcement and news on the transformation of its core business from communications hardware to cybersecurity solutions. Price has not been this high since January 2015. Next targets: $14 and $17.

Cymabay Therapeutics, Inc. (CBAY) launched out of a 36-day bull wedge consolidation, closing up 6.9% at $8.99 on heavy volume of 786,000 shares traded and no news. Analysts have voiced strong support this year for the company’s liver disease drug, now in clinical trials, based on its potential for market leadership. The stock has risen nearly 300% during 2017. If price can close above the October 30 high of $9.40, next targets are $11 and $14. (more…)