We could see a tepid recovery of yesterday’s “shock drop” in equities (as I described here), until the Fed’s next interest rate hike (possibly in March), to send Major Indices to levels somewhat higher than their recent all-time highs. But, we’ll likely see higher volatility remain in play and, possibly, more wild price swings, until then.

As I promised in that post, here’s January’s month-end summary.

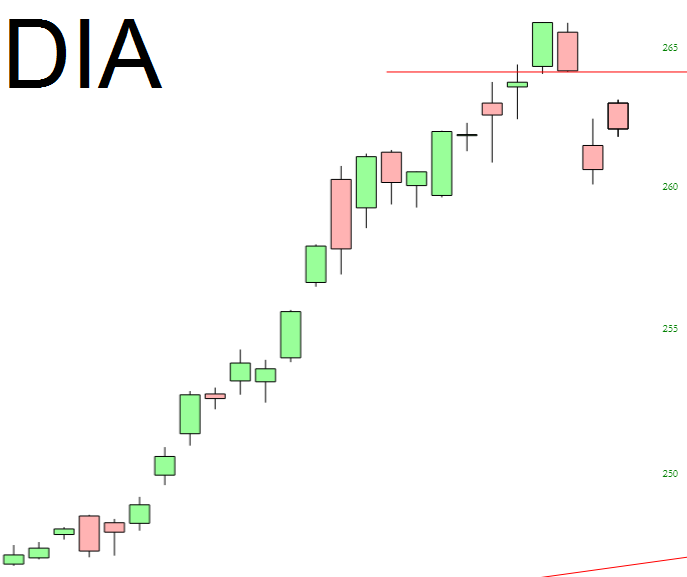

DOW 30 INDEX

The first daily chart shows that the Dow 30 Index failed to fill yesterday’s gap down and closed 100 points above its low of the day.