Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Crappy New Year!

While I suspect the thoughts of many New Year’s Eve revelers are along the lines of “I want to lose weight” or “I’m going to quit smoking” or “Maybe I’ll get lucky tonight”, I have had, for years now, a very different thought: “This was the worst year of my life.” And I’m having it again this year. The thought is crystal clear, and to my troubled head, completely true.

But why, Tim? Why the worst year of your life? Did your family break apart? No. Are you broke? No, I’ve never had more money than now. Is Slope shriveling away, since this “bear blog” has been in a bullish market for going on nine years? No, it’s not that either. Slope is actually doing great. It has a very bright future. (more…)

2017 Market Wrap-Up

This post will outline how the U.S. Major Indices, Major Sectors, S&P 500 Index and the SPX:VIX Ratio performed throughout 2017 and how they ended the year.

U.S. MAJOR INDICES

The following 1-year daily charts and year-to-date percentage-gained/lost graph show that all Major Indices, except Utilities, are trading well above their 50-day moving average, and that Technology made the most gains, followed by Transports, Large-Caps, Small Caps, and, Utilities.

Slim’s New Year Video

Big Picture Update on Commodities & Precious Metals

Note: I’d like to thank Slope readers and especially Slope’s distinguished proprietor for the opportunity to post for you tales of Amigos, Horsemen, mania, greed, arrogance, stupidity, fear, terror and all the macro nerd stuff within my view of markets. Happy New Year SoH –Gary

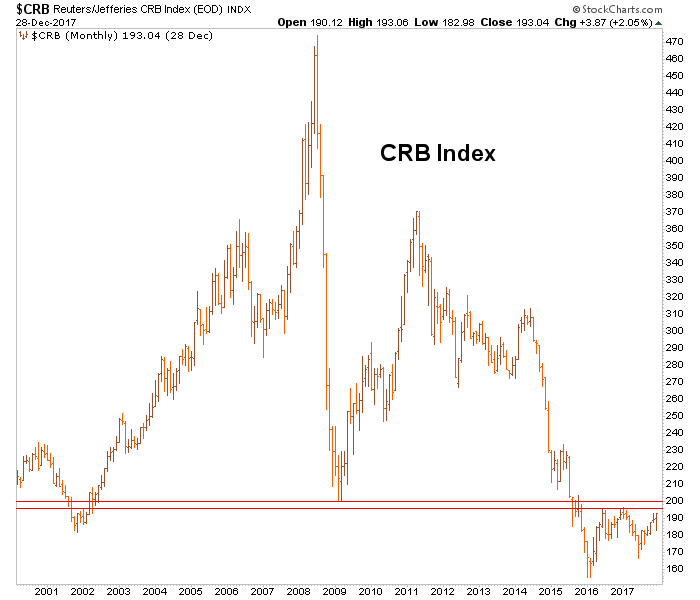

Some monthly charts of interest in the commodity sector, including precious metals.

CRB Index dwells below key resistance. A break of 200 would target around 250 in 2018.

CRB/SPX Ratio shows the utter devastation of the Goldilocks era of Central Bank inflation with no apparent consequences. This is not likely to last. (more…)