I’m typing this late Friday night in the cool night air outside of a closed Starbucks. I never thought I’d appreciate a weekend as much as this one. No GLOBEX quotes. No government shutdown. No nothing. Just peace and quiet.

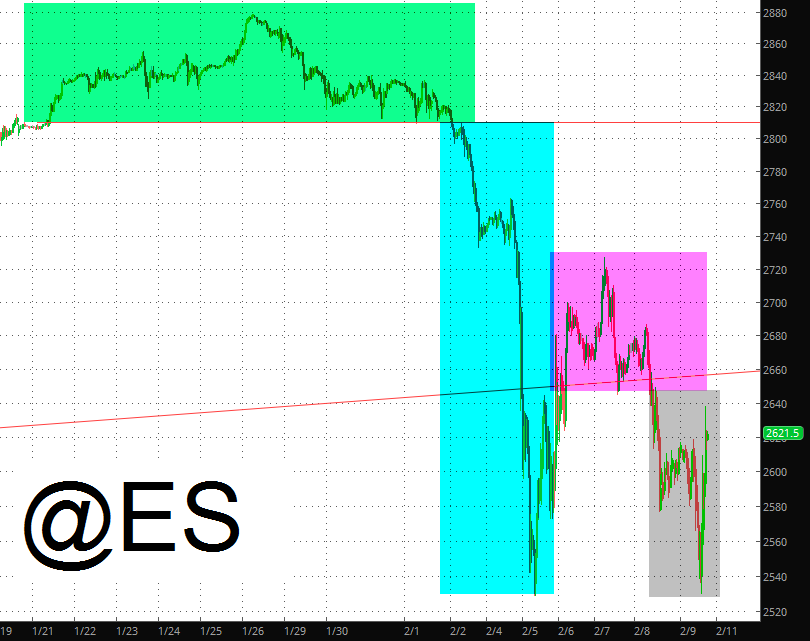

Let’s take a step back after this insane week and just drink in the basics of the ES activity for the past couple of months, which I have broken down into four simple tints:

Green: The topping pattern. Although none of us knew it at the time, the market was making its final top (and unlike my many other charting compatriots, I sincerely believe it was THAT top; I am kind of flabbergasted how many chartists, even bearish ones, have said that new lifetime highs are coming).

Cyan: Here is where everyone sat up and took notice. The market started breaking down and with increasing speed. I distinctly remember last weekend wondering if there was more to come. Esteemed chartist Tom McClellan sent out a fancy looking VIX chart to state that the selling was done. As he put it, “But when the SP500 is in an uptrend, like what we are arguably still in right now, these instances nearly always mark nice short term bottoms for stock prices.” So I was kind of bummed about the “nice short term bottom” – – but the cool part is that Monday saw the market collapse more than 1000 points. Boom!

Magenta: On Tuesday and the first part of Wednesday, we got our bounce, during which time I declared myself to be “lying in wait”. As you can see, it was just part of another topping process, which itself was followed by…….

Grey: The second plunge. By mid-day Friday, people were bug-eyed at the 3,300 drop the Dow has suffered from its peak. But the powers that be sent in the federal government buyers, and we ended Friday in the green.

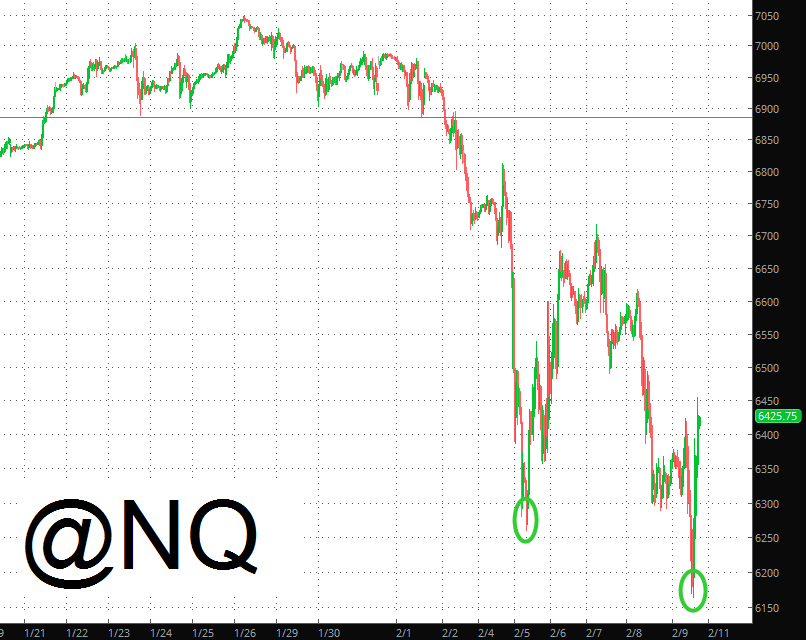

The NQ followed a similar path, of course, except for the important distinction that the second low was much lower than the first (unlike the ES, which pretty much doubled-bottom).

It was all about volatility, of course. If you asked anyone to explain why we had a 3,300 point selloff, they couldn’t point to the big nuclear strike that took place, or the news that Apple has been committing accounting fraud for the past twenty years. It all came out of nowhere. The VIX, which had been happily at 10 (sometimes even 8) for month after month after month, suddenly rocketed to almost 50, wiping out some institutional funds (and individuals) in the process.

So, unlike my colleagues, I don’t think this is a “one and done” kind of bear market. I think it’s more akin to when those first couple of hedge funds blew up in early 2007………..that is, an early distant warning.

I suspect next week will be one in which nerves calm, and VIX declines, and people buy into the “cheap” market (ha!) I’ve prepared for this by: (1) trimming back on my shorts from 73 positions to a mere 39 (2) actually buying – yes, BUYING – some ETFs in size to hedge against my shorts. Namely, IYR, EEM, EMB, and XOP.

If trading was like skiing, we just experienced a triple-diamond run during a blizzard. We have entered a new era, my friends. Our nine-year national nightmare is over.