Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

I Hear You, Fellow Slopers

Message Received

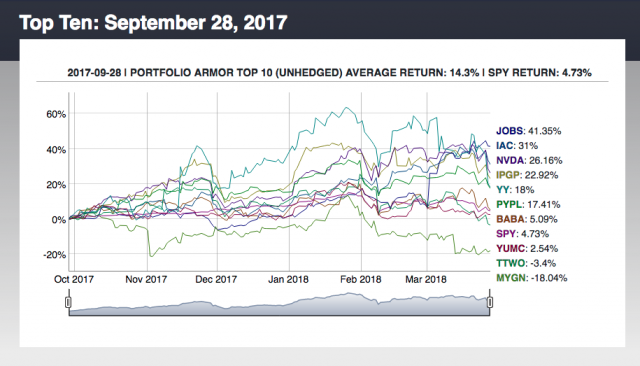

Last month, in a post about Portfolio Armor‘s security selection method (A Security Selection Method That Beats The Market), I might have included a few too many charts. At least, that’s the impression you gave in the comments. So this time, I’ve decided to use a table instead, where every starting date links to an interactive chart. (more…)

One Down, Three To Go

Today is the end of the first quarter and the first day of the second quarter on Monday traditionally leans 75% bullish. That’s worth bearing in mind here as any bullish move here may follow through on Monday.

Full Intraday Video from theartofchart.net – Update on ES, NQ and TF (at the start) and then DX, CL, NG, GC, ZB, HG, KC, SB, CC, ZW, EURUSD, GBPUSD, USDJPY, USDCAD, AUDUSD and NZDUSD:

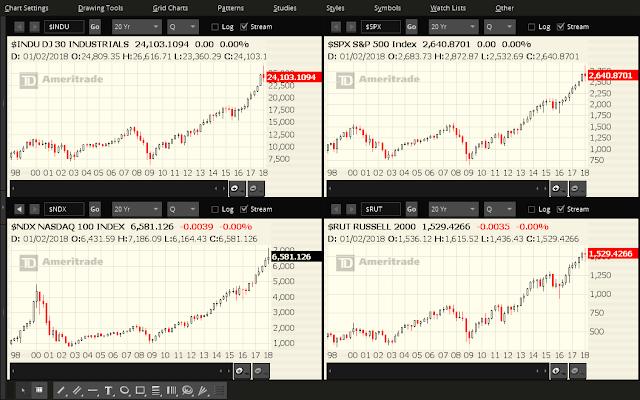

U.S. Major Indices Fail to Hold Onto Gains in 2018 Q1

Each candle on the following charts of the Dow 30, S&P 500, Nasdaq 100 and Russell 2000 Indices represents a period of one quarter of one year.

Buyers tested the waters above the highs of 2017, but were not able to hold those gains as they received little to no support to advance any further, and even gave up most of them, by the close of Q1 of 2018, with the exception of the NDX (which held above last year’s close).

Never Sell Oil on Fridays? (by Moneymiser21)

A well respected Slope trader posted more than once that he never/rarely sells oil futures (/cl) on a Friday.

So with plenty of backtesting to do on this Good Friday, I put that theory to the test, and found there’s a slight edge to that mindset.

The lookback: 5 calendar year 2012-2017.

314 end of week days (sometimes that was a Thursday)

9:00 a.m. EST until 2:30 p.m. EST (old pit hours still the highest liquidity, with 2:30 p.m. still used for settlement) (more…)