This morning’s post highlighting Jim Grant’s bond market/interest rate views (by way of Heisenberg) prompts me to reproduce publicly NFTRH 490‘s short bond segment. I may be known as the guy calling yields to decline but in context I am the guy calling for caution at a potential limit area who has appropriately called for yields to rise and decline all through the bond market’s recent history. It is important not to get lost in bias or dogma.

Bonds and Related Indicators

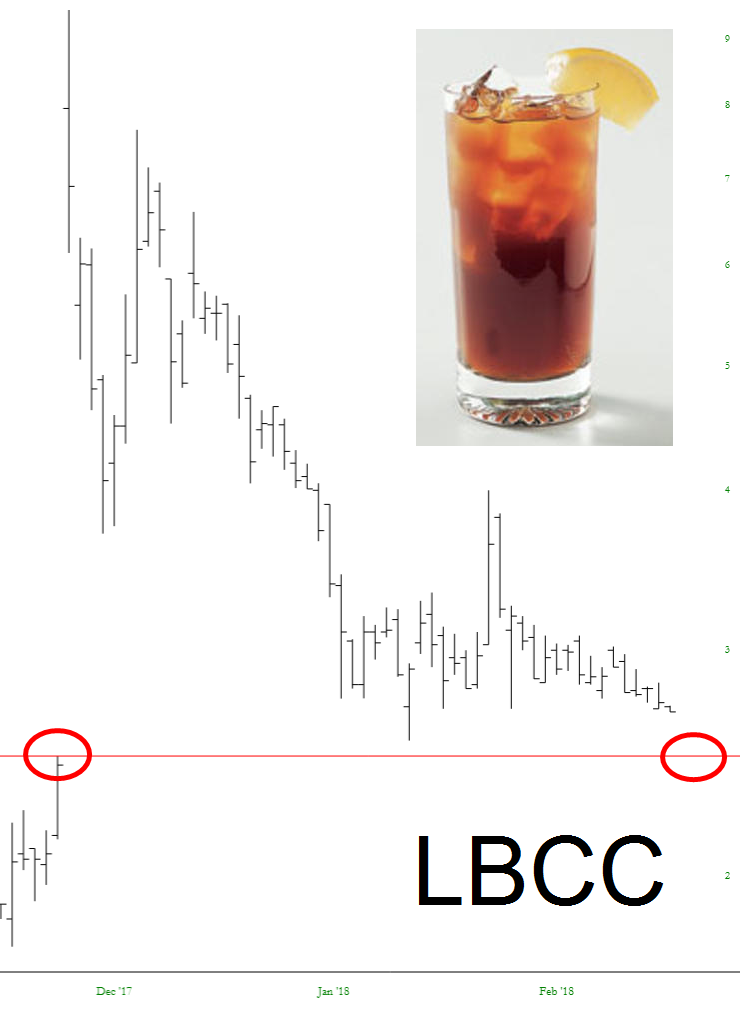

Long-term yields lurk just below our targets of 3.3% (30yr) and 2.9% (10yr). The yields on the short end remain relatively strong as evidenced by the flattening yield curve. This remains a positive macro picture (whether manipulated or not, my job is to play it straight and convey the message of the bond market, not to wear my tin foil hat).