From The Director: Tim has graciously offered to work together with me to develop charting tools that can aid the testing and design of new pre and post earnings approaches in using options to make profitable investing strategies.

Other services have benefited from using past data (both options and underlying data) to generate probabilities for certain movements in underlying stock. We can utilize these probabilities to generate option strategies, backtest the same strategies, and offer a framework wherein we trade these strategies prospectively, which can aid the keen investor.

None of what we discuss here should be construed as a trade recommendation or advice, but rather look at this tutorial as a tool you can use to improve your trading.

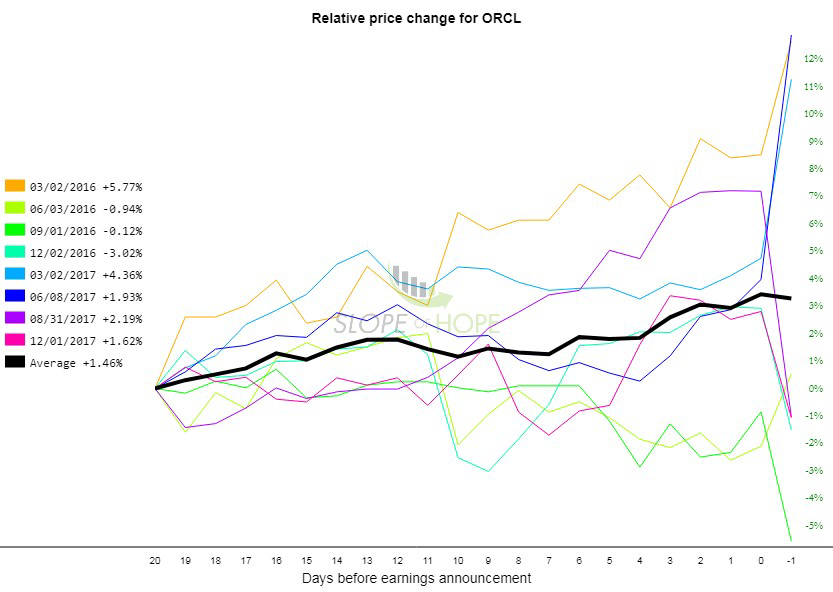

First, let’s look at ORCL, a trade idea that was discussed earlier today. Switch to earnings mode, and right click and select the TWO YEAR timeframe. In SlopeCharts, we see the earnings history here:

We see a steady upward trend from D-20 to D0. This is appealing for a potential long strategy, pre-earnings. We also can see that the percentage change at day 4– is up 1.84% and at day 0– 3.44%. So the underlying has an absolute increase on average of 1.6%.

One trade idea could be a long call. Generally, I favor using a 25-30 delta long call, as it balances out the price of the call (50 delta, or at the money calls tend to be very expensive) with enough “skin in the game” to have actual movement in the option price (5 delta calls barely move with the underlying unless there is a huge move in said underlying).

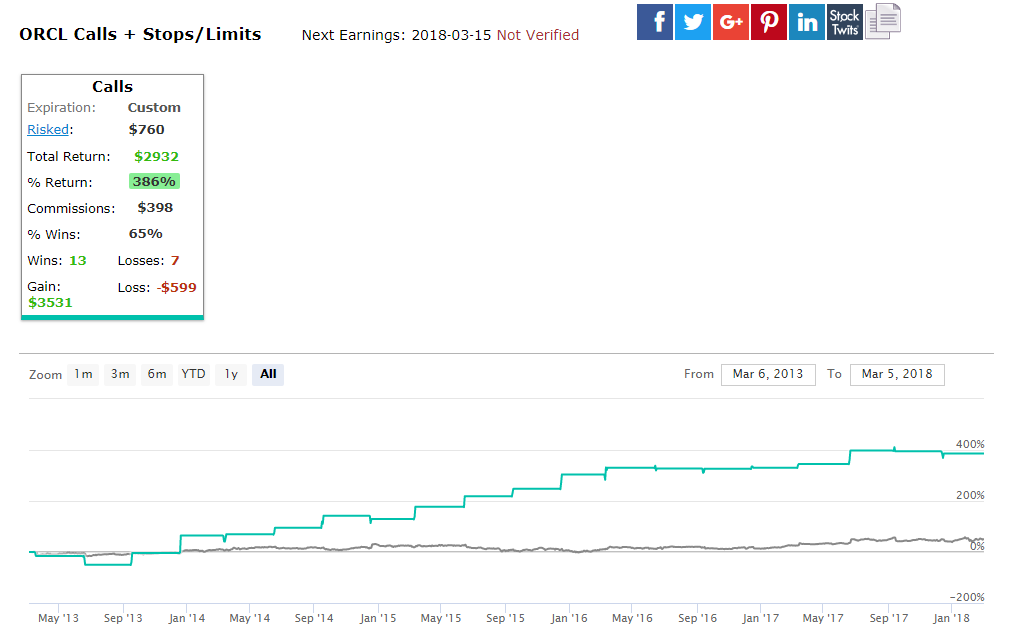

So what happens with a 30 delta call, 4 days prior to earnings, and exited just before earnings (day 0 here, as it happens after the close)?

I use CMLVIZ (tm.cmlviz.com) as my main back testing application, and it is extremely versatile and offers trade ideas on its own. I like to use such ideas with the visualization approach offered by SlopeCharts.

When I buy a call, again I use a 30 delta call. I also exit if I hit half of the max cost of my call. I do not exit based on loss (which is limited to the cost of the call). I use short term options (7 days to expiry).

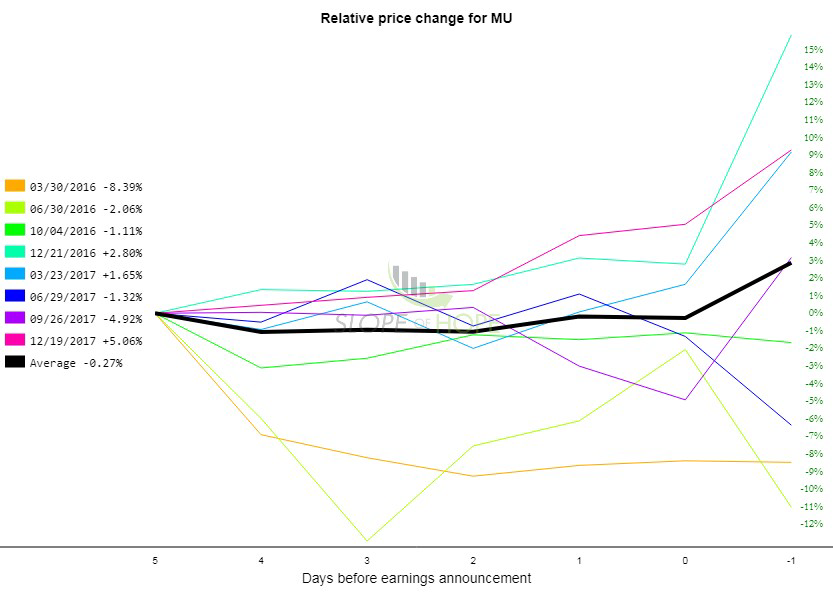

Let’s take example number two. For MU, let’s take a look at SlopeCharts Earnings Mode (2 yr mode):

At day -3, the avg is -0.93% (as compared to day -20). At day -1 the avg is -0.18%. There is a nice gain of 0.75%. Again, a long call may be of benefit.

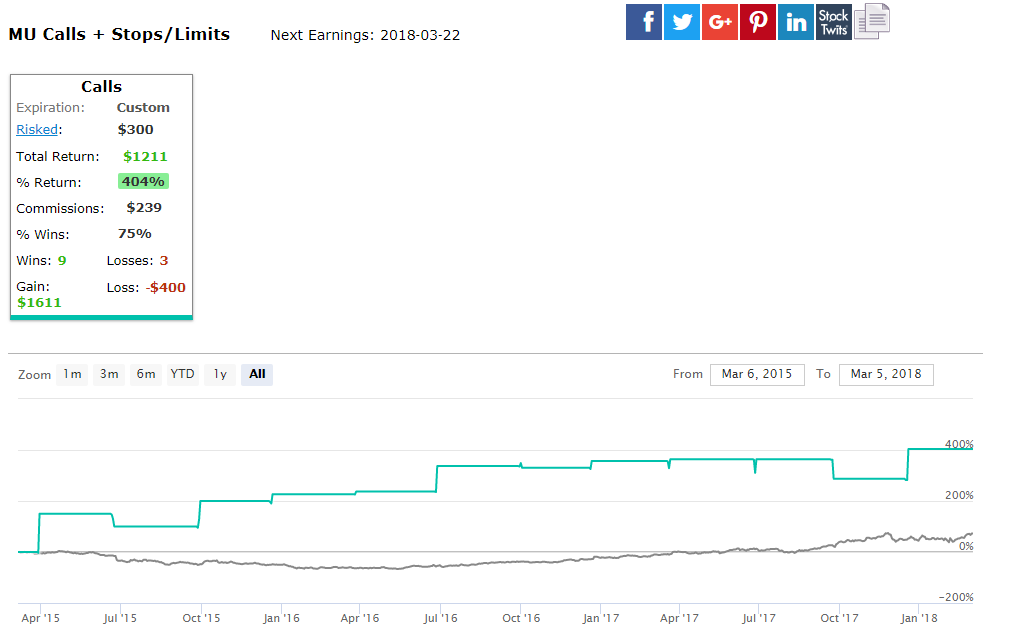

For a call: Again, I use 25 delta. I look for an option 7 days to expiry. I manage at 50% of my cost of my call. So what happens? On backtesting (3 yrs)

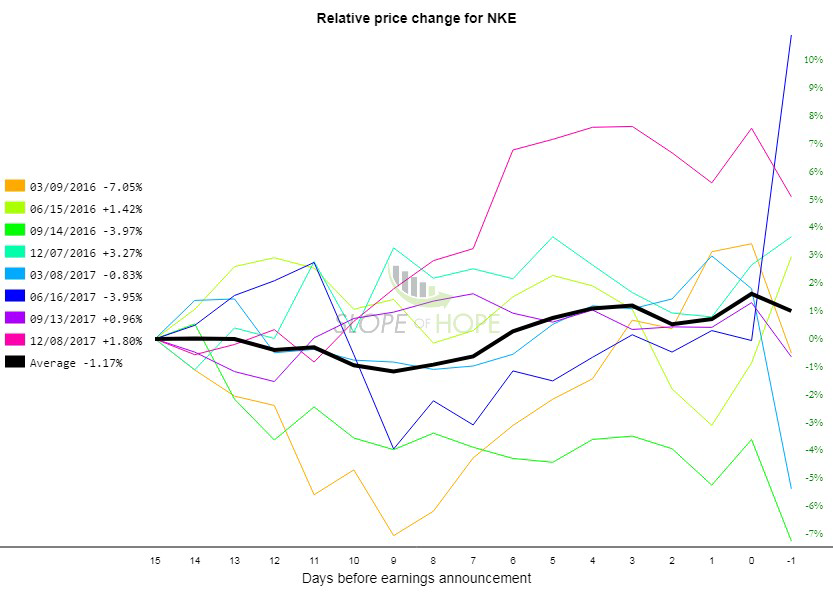

Last let’s look at Nike.

Here we can visualize a drop at Day 9. In fact, the relative price at D-9 is -1.17%, while at D-1 is +0.71 which is 1.81%! If we buy a call at D-9 and exit at D-1, we see the following:

Rather than using boilerplate strategies, you can visualize key timepoints which can be utilized for a myriad of different possible profitable trade ideas. Once we have expanded options visualization, we’ll be able to plan more complex strategies that offer even more possible profitable avenues.

Our eventual goal is to offer a complementary service to Slope of Hope which will offer Option visualization, earnings visualization, and also educational trade ideas which combine option strategies with the exceptional charting skills of Tim.