Okay, so now here come the bullish articles about how it is different from 2000 and 2007, how Elliott Waves predict a rise to SPX 3000 (maybe, because it may go down first) and after the fact, how peachy everything still is. Now, I am not saying the writers linked above (one of which was @ Biiwii) are flipping to or fro; just that they are with the general mood out there that is nice and comfy again.

But when we had our real-time subscriber update (now public) the mood, amid Italy and Trump Trade uproars, was anything but comfy. Indeed, the cacophony was in full swing and I felt the need to make sure we had the correct parameters rather than the incorrect parameters of sensation and emotion going on in the general financial media. Big deal, the S&P 500 was conducting a test of support and it was doing so amid an inflammatory news cycle. Where have you heard that before?

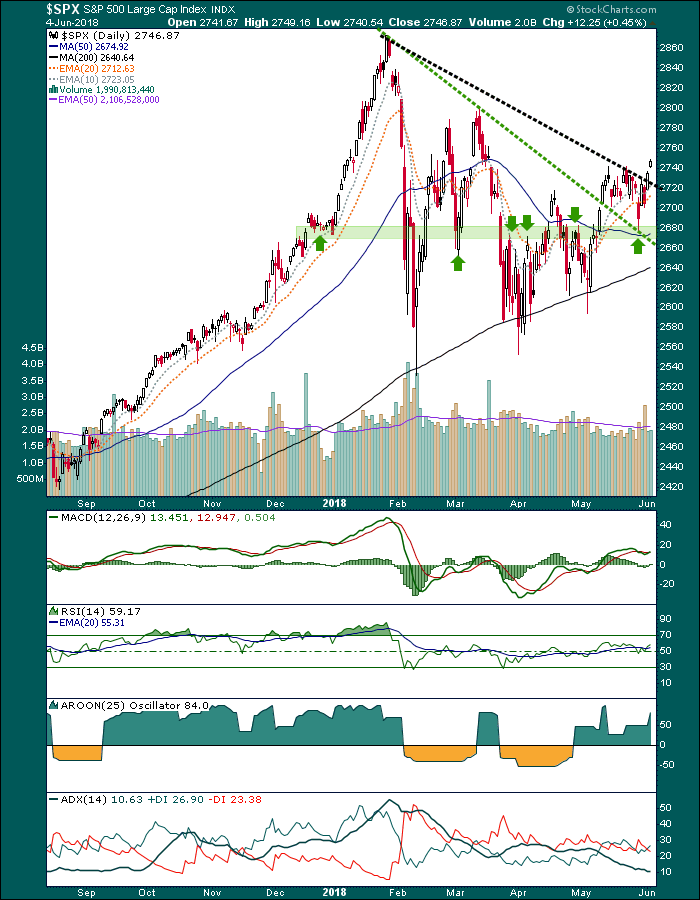

Here is the updated chart. In the span since our “high priority” (I reserve that descriptor for strategically key moments) update, the Good Ship Lollypop has held support like a charm and proceeded northward, in line with our favored plans.

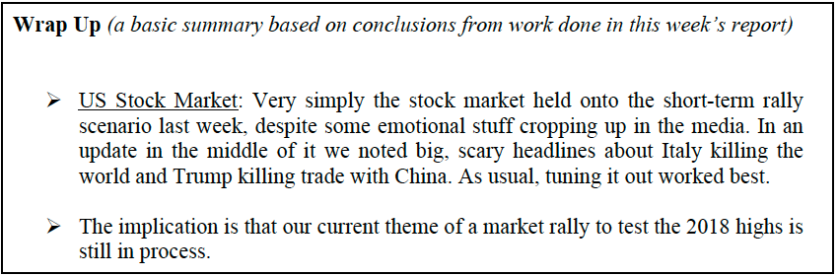

As NFTRH 502‘s Wrap Up summary put it on Sunday…

Ah, but what comes next? As we go further out on the time curve I for one try to be humbler in making a <insert dreaded word, “forecast” here>. But we do have rough plans beyond a top test. Also from the the Wrap Up, after laying out those plans.

Now let’s keep this stuff in perspective and realize that we are just developing an operating plan, which is likely to change to minor or major degree along the way.

As noted last week when giving a general review of the situation…

The first part of that statement is pretty firm; it could get dramatic this summer. The second part is pure projection (bullish to bearish to bullish again) at this point. But the narrative we are currently successfully working on today was once a projection as well. You’ve got to be able to look ahead and map out plans, eh?

Dialing back to the here and now, the NFTRH update provided a front row seat, in advance, to what micro history (the last week) now says is 100% fact; the stock market was at support during the worst of the media scrum and it held that support and to this morning at least, maintained its track to the favored view, which is a coming test of the highs.

Now, a test of the highs could mean a throw over (Nasdaq 100 is almost there and the Russell 2000, which was also noted for its intact Ascending Triangle breakout in the above-linked update, is flying in blue sky) to new highs in the S&P 500 or it could mean a marginal lower high. A test, if it comes into play as expected will take a ton of patience and perspective.

If SPX breaks to new highs some will be calling it a 5th wave up and do you know what? If that comes about it will morph the ‘top test’ scenario into a final bull market wave blowout scenario, probably to a future cyclical bear. So again, the further out you get the less accurate we (analysts, wise guys and media-anointed charlatans) market watchers are likely to be.

So the main working theme has been a top-test and beyond that I keep plans, subject to revision/enhancement though they certainly are. What’s more, there will be a painful correction out ahead, but to get to that point intact and profitable, we have got to figure out the path to it along the way. The first step is still on track as of this morning’ projected flat open. Let’s have open minds and bias-free orientations.