The image I have in my mind as I sit here now is an opening scene in the old television show Kung Fu, in which the monastery has hundreds of candles burning and flickering. Metaphorically speaking, each one of those candles represented, for me, hope that this incredibly highly-valued market would actually turn lower in a meaningful way. Indeed, early in February, it seemed that the few candles that were allowed to remain suddenly starting shooting three-foot flames toward the ceiling.

Sadly, I think there’s about one birthday cake-sized candle left, and the market has already unzipped its pants and is standing over it. Virtually every major index, as I’ve written with increasing despair lately, seems poised to rocket higher on another meaningful upleg. Volatility, the very essence of the sort of fear that is my stock in in trade, has been smothered in its crib for the whole of 2018, as it approaches single digit levels.

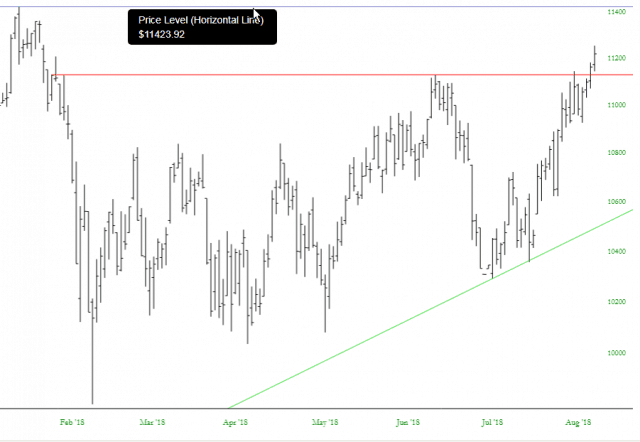

Here, for instance, is the Dow Transportation Index, which has cleanly cleared its horizontal line and is getting within reach of its lifetime high (the blue line). This chart is straight-up bullish.

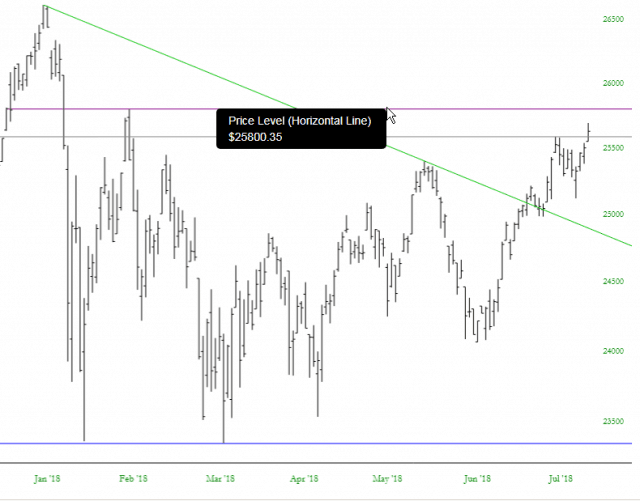

So, too, is the Dow Industrials. Although it is still over 1000 points away from its lifetime high, it is still a bullish foundation, and clearing 25,800 would hypercharge the launch. I mean, let’s face it, we live in an age where CEOs can tweet anything they want to goose their stock prices higher (I’m looking at you, TSLA) without fear of consequence or even inquiry. This is a no-holds-barred bull market.

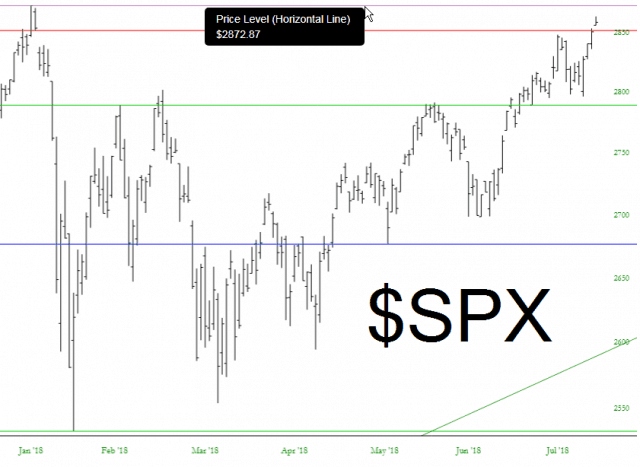

The S&P 500 is one medium-good day away from its own lifetime highs.

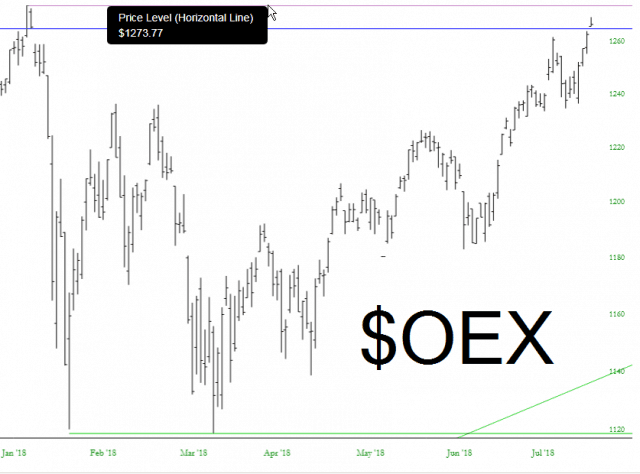

As its the S&P 100 cash index.

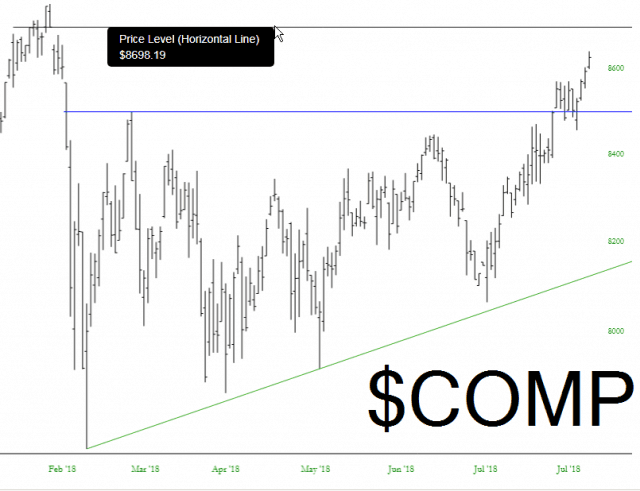

The Dow Jones Composite, even after being watered down by Utilities weakness, has just about closed its price gap, which is where I’ve anchored the horizontal whose price level is shown.

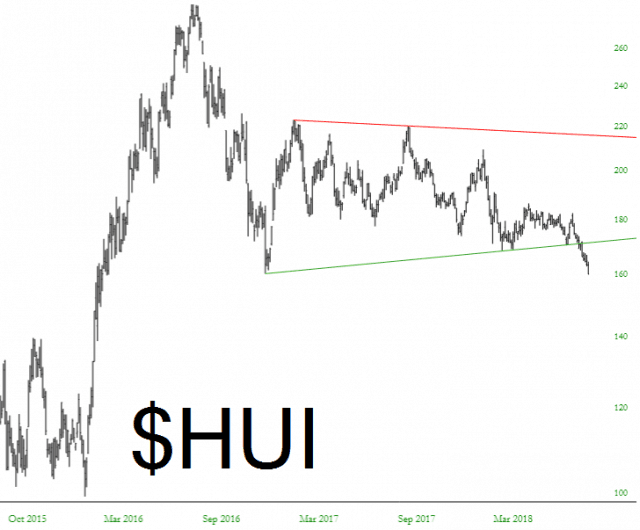

There are really only a couple of sectors that seem truly bearish. One, of course, is precious metals, which is a train wreck. Gold has been losing ground for nearly seven years now, and the gold bugs index recently gave way to a pattern which spells even more heartache for the “real money” crowd.

And, of tremendous interest to me, the Dow Utilities is still in one of the most exciting setups I’ve ever witnessed. An upside breakout here would, let me confess, break my heart.

In any case, there’s almost no hope for the bears left. This is statistically the most bearish time of the trading year (August and September), and we seem to simply go up half a percent or so a day, day after day, just like we did for so many years prior to this one. It’s just a slow “melt up”.

Because if AMZN isn’t a bargain with a P/E of 150, what is?