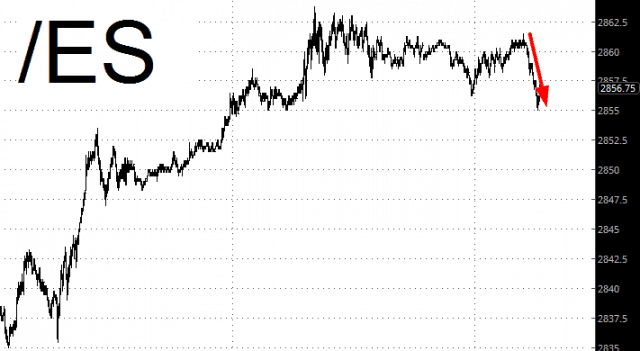

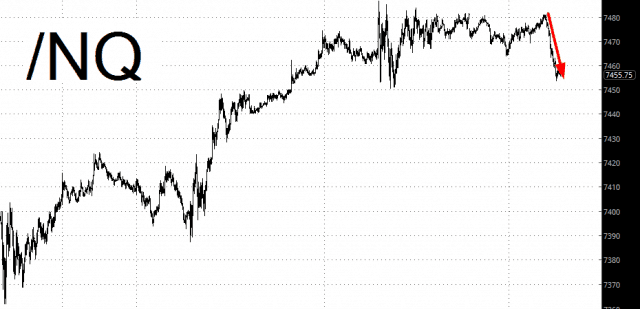

It’s been a very long time since I’ve woken up to a screen entirely red. Everything is down – – ES, NQ, crude oil, bonds. Of course, these aren’t huge drops, but at least the color is right.

I guess the inspiration is the tit-for-tat trade war going on between the US and China. One wonders just how much hundreds of billions of dollars in goods need to be subjected to these tariffs before the market really feels it. For our only family, we bought a new washer/dryer combination before these surcharges were slapped on.

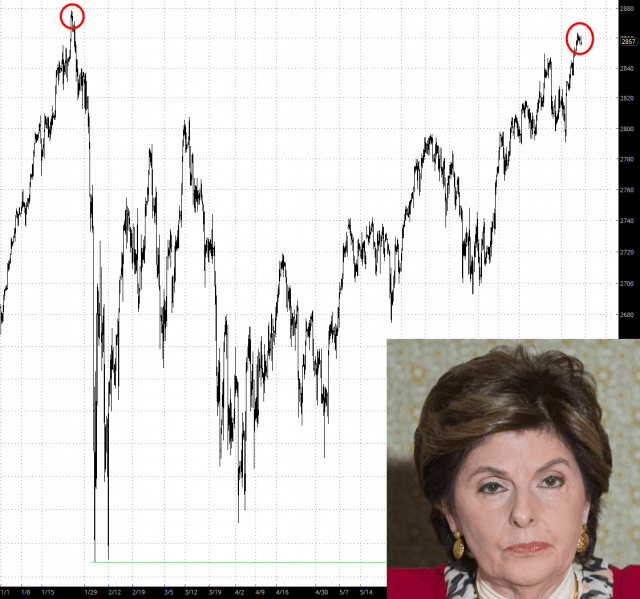

Taking a look at the longer view of the ES, we are terribly close to the lifetime high set in late January. It’s pointless to speculate about a possible double top. The screen could be solid green in an hour, knowing this fickle market.

The NASDAQ likely gave up modest overnight gains. As an aside, I am extremely interested to hear what finally happens with that Tesla insanity yesterday. Truly unprecedented stuff.

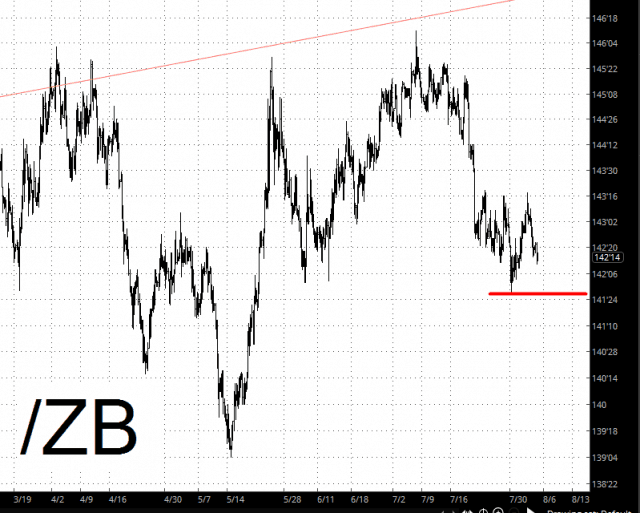

Perhaps most pleasing to me is that bonds are down even with equities lower. I’ve marked in red an important break point which, should it be violated, will get us away from this incessant “trendline tractor beam” that has been happening for the entire year. It could commence a more meaningful breakdown.