SPX has made a possible short term high a couple of days ago, but needs to show us more on Tuesday than a retracement to test obvious support at the 50 hour MA, currently in the 2890 area. If that can be broken, and the open gap below it filled, then there is a decent shot here at seeing a retracement into rising support from the late June low, currently in the 2840 area, to confirm the rising wedge from there within the overall rising channel from the overall rising channel from the early May low.

This is the equity index section of my premarket video for this morning which talks more about the evolving setup here. Partial Premarket Video from theartofchart.net – Update on ES, NQ:

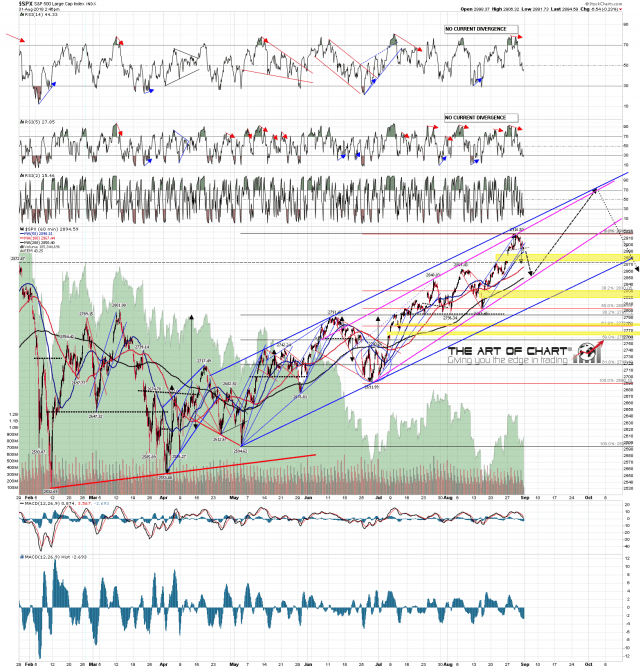

On the chart below I have drawn in an ideal path for SPX over the next few weeks into the significant high that we are expecting in late September / early October. This would be an ideal way to trade the next few weeks if it plays out this way. SPX 60min chart:

Some announcements today. We are doing our monthly free public Chart Chat on Sunday 9th September running through the usual 35 to 40 instruments over a very wide range of markets and, if you’d like to attend, you can register for that on our September Free Webinars page.

We are also running another Trading Academy Boot Camp soon and that is starting Monday September 10th. The first two were very well received, and you can see testimonials from that as you scroll down on our testimonials page. It is also cheaper (and at least in our view better) than anything comparable on the market, and likely to be the last one we run this year. At the moment there are still places available and, if you’re interested in attending, you can find out more and register for that on this page here.

Everyone have a great weekend. 🙂