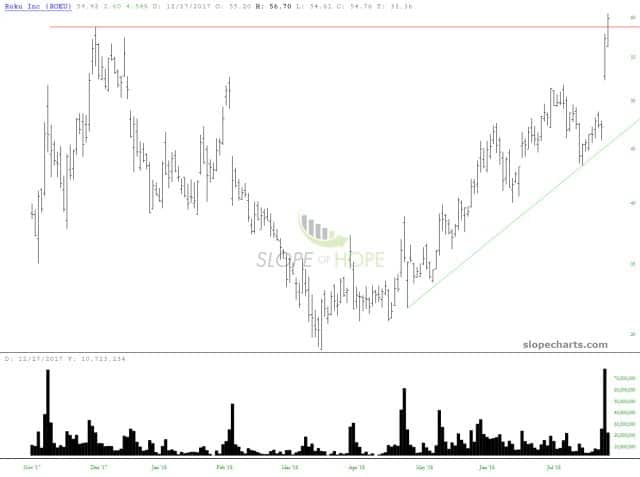

Preface to All Four Parts: I am presently short 74 different positions. I actually intended to be short 80 positions, but the market closed on Friday faster than I could finish the orders. I am showing all 74 charts across four posts this weekend, but unlike the past, this isn’t a “half for everyone, half for PLUS only” deal. From now on, PLUS members are going to get the vast majority of the charts. Non-paying readers will get a sampling of the charts, and PLUS members will get the majority.

These are all ‘live” positions, and recently they have been doing a yeoman’s job of outperforming the market. Click on any thumbnail for a big version, and you can scroll left and right through the gallery. I have tried to zoom in (when appropriate) on the portion of the chart I believe is most germane and illuminating to readers. So if you’re not a subscriber yet, please read the reasons for being one.