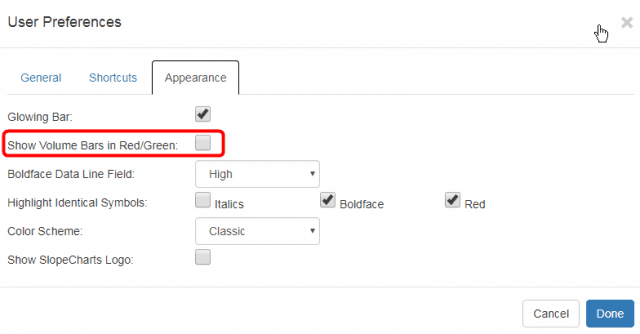

SlopeCharts is on a ceaseless pathway of improvement. Today’s new feature is color volume bars, which has been an oft-requested upgrade. You can find the toggle for this over in the Preferences dialog (the gear icon on the extreme right of the tools).

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Ken Burns and Vietnam

Those of you who are Netflix subscribers have no doubt seen the description of the Vietnam War documentary on there. Ken Burns created it, and although I had seen the “link” for it dozens of times, I never bothered to delve into it.

Low IQ

Anyone out there remember a company called Iomega? There were a firm that made these hideous things called ZIP Drives, and for some reason, trading their stock was all the rage. It made sense at the time, since Iomega shares seem to do little but go up every day.

How Low Can Gold Go?

The downward plunge never ends when you think it will. There’s always a lower level. That way gold bug spirits get crushed before those left standing can become “joyous”.

Some thoughts from NFTRH 510:

Both gold and silver look like they could be in little daily chart bear flags. Oh no! More bearishness on the way! I am getting bullisher by the week.

Again, that is how it is with the precious metals. Sure, if you go too quickly you get some cuts, scrapes and if too eager, even amputations of fingers by falling knives. But this generally is the type of environment where you stand up and take notice. The gold obsessives – i.e. gold newsletter writers, gold stock experts, “gold analysts” (ha ha ha) and others who want their herds to remain enthralled as if there is no other sector in the markets – are in damage control mode.

Because gold and silver are technically bearish, the gold stock ETFs are on the verge of breakdowns and the world is still risk ‘on’ right now, the amalgam known as the gold “community” may find a need to give the troops the straight scoop, which is that it’s bearish out there. With every fiber of its being the “community” wants not to be saying that, but they have to in order to maintain credibility.

This is when you buy the sector. Period. Now, what does “buy” mean? Well I personally screwed up trades in NEM and AEM. So I am by no means saying that [it] is easy. You have to manage risk while at the same time keeping an eye on the ball, which is a general buying opportunity for anything from a potential strong bounce to a bull phase.

As to that second thing, a turn in the risk ‘on’ world to bearish and/or risk ‘off’ would be the right context. What is happening now is that the inflationists are getting dismissed and the people who buy liquidations within disinflationary backdrops are at the ready. While I am bullish on all counts but the macro fundamentals – which continue to be mixed to bearish – I’d continue to respect the possibility of a final flush before the rally gets going.

Team America Bar