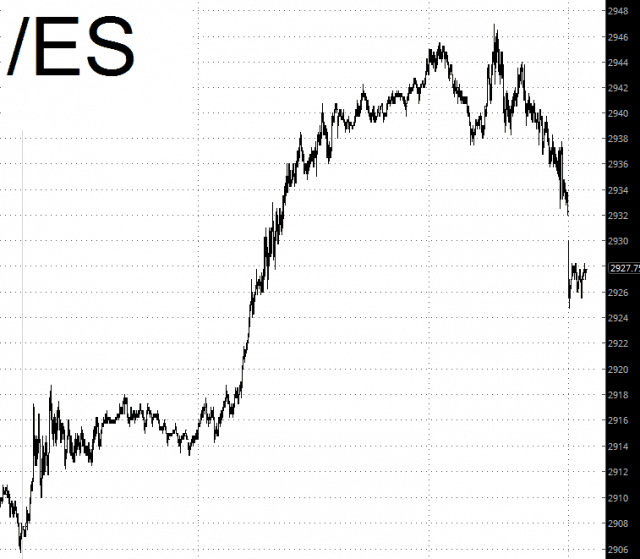

So if the prospect of a relaxation in trade wars is worth 3,000 points on the Dow, then surely the total collapse of trade talks is worth – – what – – about 70 points or so? Anyway, as I type this on Sunday evening, the ES is down, getting slaughtered and vanquished to the tune of two-tenths of a single percentage point. It’s just like last weekend. A mountain of bad news resulting in a tiny downtick, all of which will be green by tomorrow, right?

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

More Options Ideas

Note from Tim: I’m pleased to present another options trade ideas offering from Slope’s own The Director! Behind the scenes, we are beefing up the Diamond membership to encompass tools for options traders, and we’re whetting appetites out there with posts like these. Enjoy.

Outside of earnings ideas, here are some ideas based on edges in the field.

The Bollinger Band

The Bollinger band is a graphical standard deviation range away from the 21 day moving average developed by John Bollinger. The TTM squeeze is a proprietary indicator developed by John Carter that describes a state that where the Bollinger band is in a compressed, low volatility state.

When charts are in a lowered volatility state, they have an increased probability of a larger move in a specified direction. One can discern a higher probability of a certain direction using either the value and /or slope of simple momentum, or an increasing slope of the relative strength indicator (RSI), or the use of the Williams accumulation/distribution index’s slope diverging from the price. (more…)

Noah’s Arc

Crude oil has been sailing above its supporting trendline for a couple of years now. I am, of course, watching with great interest to see if we get a break of that uptrend.